The U.S. Department of Agriculture’s (USDA) attaché office in Ankara, Turkey issued its Select Oilseeds and Products Annual Report in early March. In the report, the Post noted that, despite recent economic issues that have led to soaring inflation, demand for oilseeds and their products are expected to rise, thanks to the growing population and improving household incomes. As a result, this is expected to spur increased demand for livestock, poultry, and aquaculture.

The Post notes that, according to government sources, Turkey’s poultry broiler industry grew by about two percent to reach 2.22 million tonnes in 2018. This is well below the initial target growth of ten percent that was thwarted mostly by the weaker lira, which hurt consumers’ buying power. Broil meat is the cheaper alternative when compared to red meat and expectations for continued population and tourism growth are expected to bolster demand in 2019.

Turkey is heavily reliant on soybean imports, as production is far exceeded by marketing year imports. The Post estimates that Turkey will see soybean imports grow from 2.8 million tonnes in the current marketing year to reach 3.0 million metric tons (MMT) in the marketing year ahead.

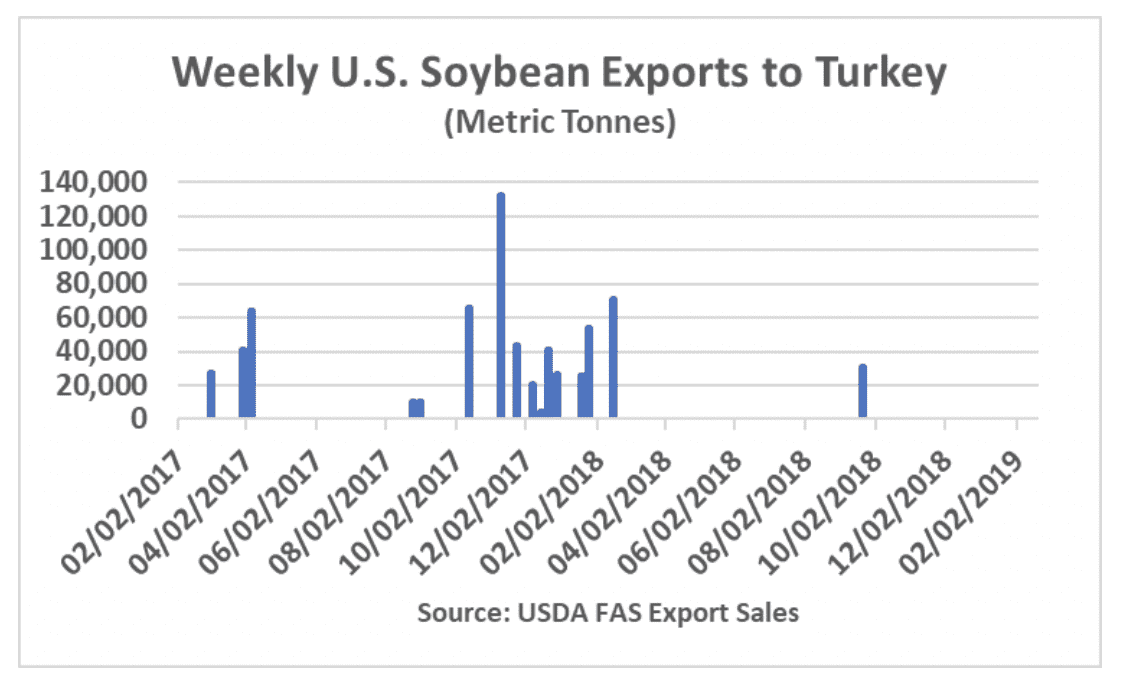

According to Foreign Agricultural Service (FAS) trade data, the U.S. has shipped just 31,000 tonnes of soybeans to the country and zero soybean meal. The chart that follows shows the weekly history of U.S. soybean exports bound for Turkey going back to February 2017 as reported by the USDA’s FAS Export Sales Query System. The data shows that shipments of U.S. soybeans spiked in late 2017 to early 2018 before all but shutting off. The slowing shipments have been attributed to importers’ concerns that unapproved soybean varieties may lead to shipments being rejected. This has kept interest limited for U.S. soybeans, and buyers have been unable to take advantage of lower priced U.S. soybeans relative to South American supplies in recent months. A push to speed up the approval of U.S. soybean varieties already permitted for shipment to other markets would help Turkish buyers capture favorable pricing opportunities already available to buyers in other destinations.