The evolution of biofuel policy continues to push for expanding output. Recent developments this past quarter suggest that many countries, including the U.S., have worked to close loopholes in existing policies and push for larger biodiesel consumption. The impacts of these developments are expected to increase global biodiesel supplies in 2019.

The largest driver of growth is expected from Southeast Asia, where growing palm oil supplies have spurred cheaper prices along with a greater push for biofuel processing. Top global palm producer Indonesia saw its government increase the blending rate of Palm Methyl Ester, or PME, into biodiesel blends to 20 percent (B20) in September, with plans for expansion to B30 by 2020. In Malaysia, the government has made another push in late-November to require B10 biodiesel consumption in its domestic diesel fleet. Larger domestic biodiesel consumption targets are expected to lend support to palm oil prices and decrease competition for other fats and oils on the global market.

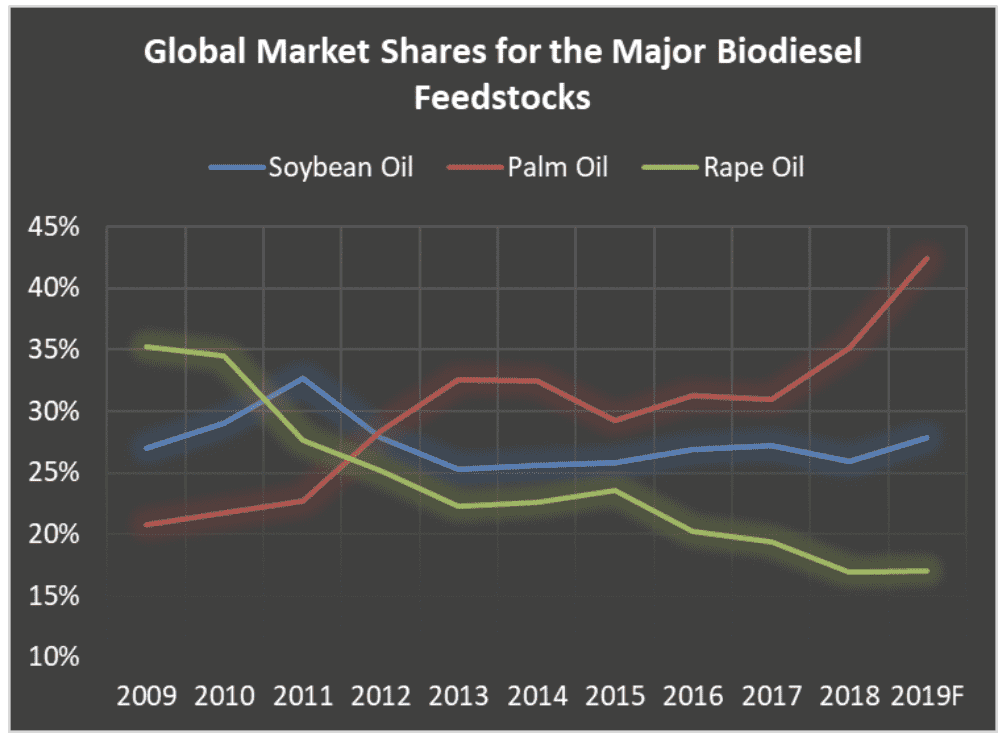

Biodiesel from soybean oil feedstocks, known as Soy Methyl Ester or SME, are also expected to expand in the year ahead but to a lesser extent. The last half of 2018 has seen plenty of hurdles for SME production in South America that have curbed output heading into 2019, and these ripples are likely to linger in the first half of the calendar year. Brazil has taken advantage of greater export demand for soybeans from China in recent months. Greater export demand for beans has curbed domestic crush levels and have trickled down to reduce feedstocks for SME in the last half of 2018. However, SME supplies are expected to rebound in 2019 with lofty expectations for new-crop supplies. Brazil has issued plans to expand domestic requirements from B10 to B11 in 2019 which is expected to help spur greater SME output, and the newly elected president has started his administration with a pro-business agenda. The chart that follows shows that while soybean oil use into biodiesel is expected to gain market share in 2019, gains from palm oil are likely to be substantially larger.

Muddying the outlook somewhat has been the recent slide in global energy prices. While lower energy prices would hurt biodiesel production margins and may limit the economic incentive to consume biodiesel, growing government mandates should be strong enough to convert more fats and oils to fuel in 2019.