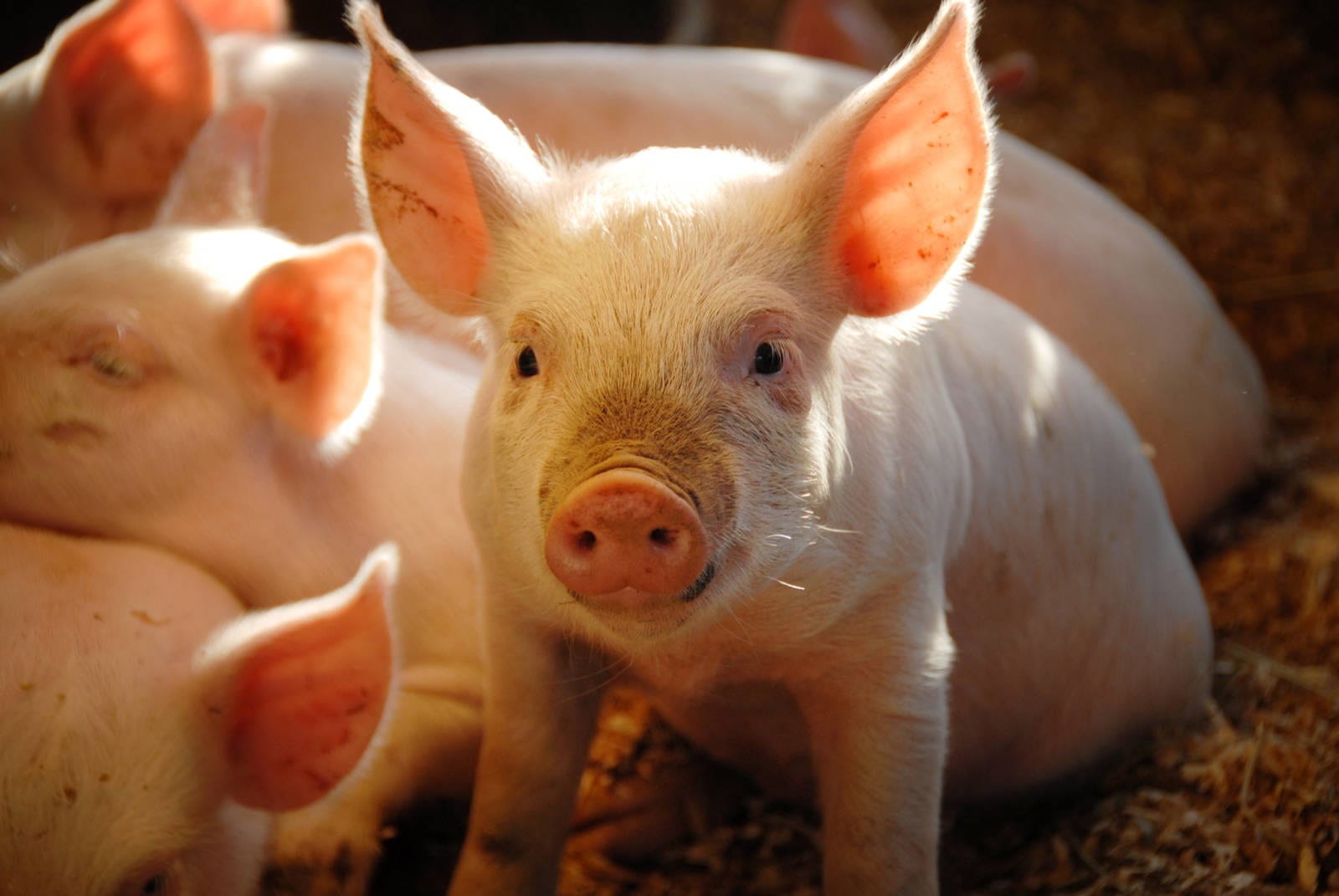

The lingering impact of the African Swine Fever (ASF) epidemic that first surfaced in August 2018 is expected to limit China’s demand for oilseeds as the country’s hog industry grapples with controlling the outbreak before repopulating its pig population. The Foreign Agricultural Service (FAS) post in Beijing issued an updated report in early May, which updates the situation by adding some number estimates to what a vaguely defined impact has been up until this point.

The Post estimates that swine feed production will slip 18.9 million tonnes in the current 2018/19 marketing year as pork output is expected to decline by 4.7 million tonnes. Tempering losses to some degree, however, are moderate increases to other animal-based proteins including increased poultry, beef, and seafood demand. China’s Ministry of Agriculture and Rural Affairs (MARA) estimated that in 2018, total feed production rose 2.8 percent from 2017 to 228 million tonnes, while compound feed rose 4.6 percent from 2017 to reach 205 million tonnes. These gains would have been greater if not for the culling of sow and hog herds in hopes of curbing the spread of ASF. Looking ahead, the Post referenced a senior industry analyst as having projected feed demand to decrease nearly 12 percent, thanks to a reduction in swine feed of 27 percent. Another industry source indicated that hog inventories will decline by 30 percent in 2019 and that it may take up to two years for inventories to recover. That isn’t likely to occur until the disease has been controlled, which has not been reported to have happened yet.

In terms of soybean demand, the ASF outbreak is expected to curb China’s soybean imports from 94.1 million tonnes in 2017/18 to the Post seeing 2018/19 imports at 4 million tonnes below the U.S. Department of Agriculture’s (USDA) April World Agricultural Supply and Demand Estimate (WASDE) of 88.0 million tonnes. The Post is also carrying a crush forecast that is 2.5 million tonnes below the April WASDE projection, with minor reductions relative to the April WASDE in both food and feed domestic consumption. Looking ahead to the upcoming 2019/20 marketing year, the Post expects for Chinese soybean imports to slip another 1 million tonnes from 2018/19 to 83.0 million. Crush is expected to slip 3 million tonnes to 82.5 million.

This extended decline in Chinese oilseed demand is expected to continue to weigh on global oilseed prices. Growing supplies following bumper soybean crops in both North and South America, along with expanding sunseed output focused primarily in eastern Europe have provided crushers with plenty of substitutes in the current marketing year. These increases have helped to dampen the impact of smaller global rapeseed harvests in both the European Union and Australia. It may take a major production shortfall somewhere in the Northern Hemisphere oilseed crop this summer to lend a degree of support to global oilseed prices should China continue to see reduced feed needs.