The Lower Mississippi River is at flood stage from Cairo, Illinois to the Gulf of Mexico, which results in the Coast Guard issuing safety restrictions. American Commercial Barge Lines reports that “the current 5 to 10 barge tow configuration results in a reduction in productivity of 14% to 24%. Furthermore, daylight restrictions in Memphis, Helena, Vicksburg, and Baton Rouge are increasing transits by as much as two days or 40%. These flood conditions are expected to remain until late March. To maintain commitments to service in the Gulf, ACBL has increased their shuttle boats from four boats to seven at significant expense.”

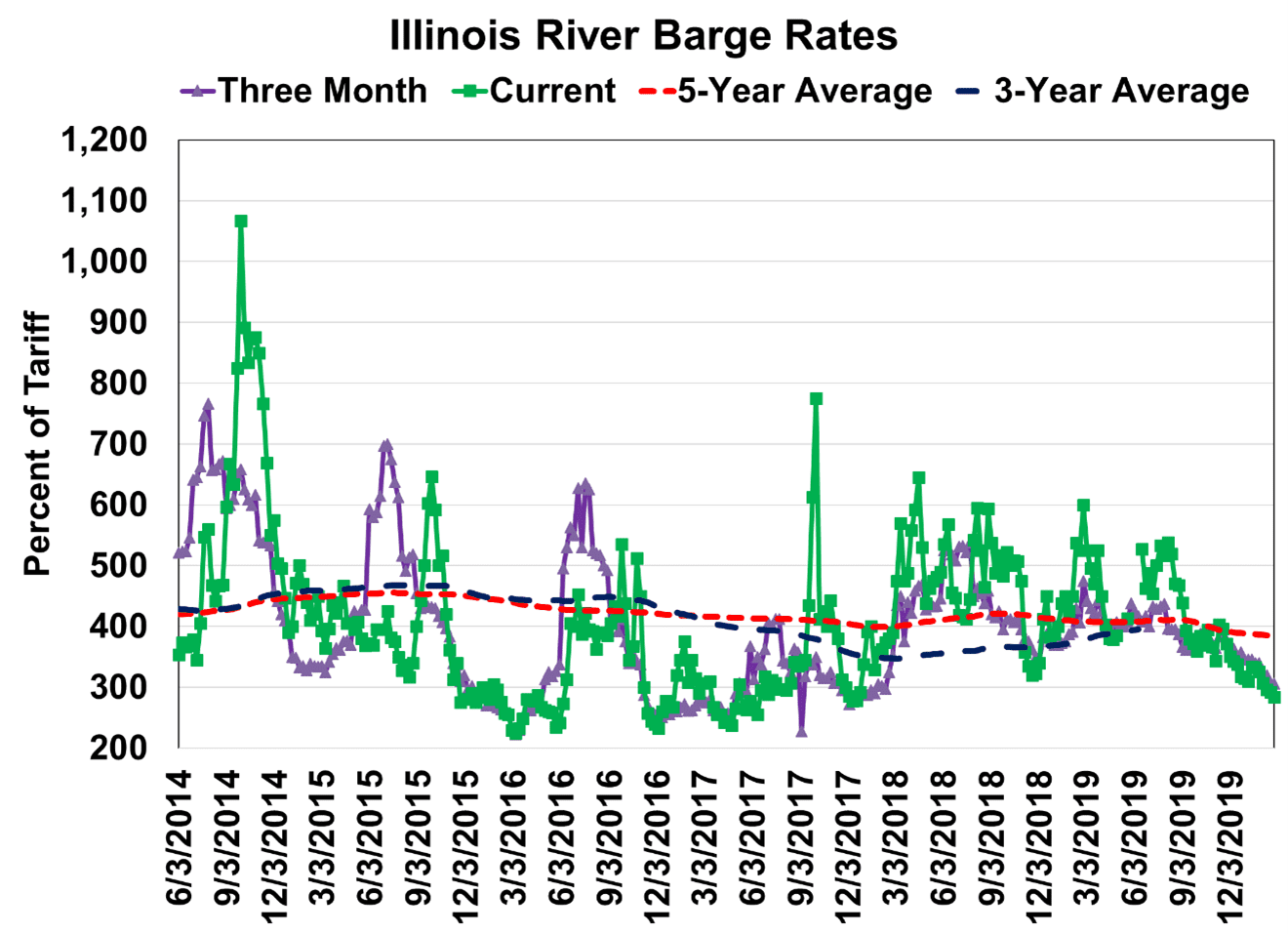

If more equipment is required to move the same amount of freight, the operational cost obviously increases. For contracted freight, the carrier makes an implicit assumption about the operational cost, and the towing restrictions represent lost income. For the carrier, the good news is that the inefficiency creates a shortage of equipment for spot moves, which usually results in a barge tariff rate spike. The fact that barge tariff rates are declining to extreme lows during a time of tow restrictions indicates the barge industry has excess capacity. The barge freight rates continue to remain near historical lows. A detailed explanation of barge freight rate calculations is provided at the end of the article.

The problem is a drop in cargo volumes. A long-term trend is coal volume continues to decline as coal plants switch over to natural gas. Energy Information Agency continues to forecast a decline in domestic coal consumption. In addition to the long-term trend, a warmer than normal winter decreased short-term consumption. In term of ton-miles, grain and soybeans are the most important commodities. A ton-mile is distance times number of tons loaded on the barge. Crop barge movements are much longer distance than coal barge movements. The coronavirus is hurting short-term exports. A major infrastructure bill that increases the movements of other bulk commodities, such as concrete, steel, and aggregates, barge commodity movements will likely not happen in an election year.

While the oversupply of barges versus demand is taking a toll on barge companies, the low tariff rates are positive for soybean farmers. Declining barge freight rates will improve the soybean basis in the Corn Belt.

According to the U.S. Department of Agriculture’s (USDA) Agricultural Marketing Service (AMS), “the U.S. Inland Waterway System utilizes a percent of tariff system to establish barge freight rates. The tariffs were originally from the Bulk Grain and Grain Products Freight Tariff No. 7, which were issued by the Waterways Freight Bureau (WFB) of the Interstate Commerce Commission (ICC). In 1976, the United States Department of Justice entered into an agreement with the ICC and made Tariff No. 7 no longer applicable. Today, the WFB no longer exists and the ICC has become the Surface Transportation Board of the United States Department of Transportation. However, the barge industry continues to use the tariffs as benchmarks as rate units.

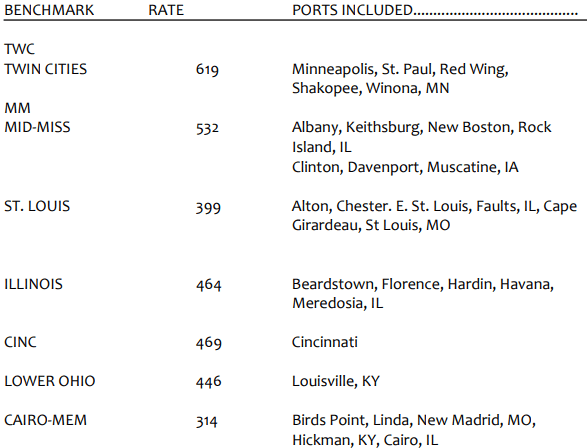

To calculate the rate in dollars per ton, multiply the percent of tariff rate by the 1976 benchmark. As an example, a 200 percent tariff for Minneapolis-St. Paul barge grain would equal 2.00 times the benchmark rate of $6.19, or $12.38 per ton. Each city on the river has its own benchmark (see table below), with the northernmost cities having the highest benchmarks.”

Inland Mississippi River Tariff Rates