Over the near term, the U.S. Coast Guard, due to flood conditions, has reduced barge tow configurations from St. Louis, Missouri to the Gulf, which reduces tonnage per tow that in turn, increases the number of round trips to fill an export order and ultimately results in higher barge tariffs. On the mid-Mississippi River, tow configurations have been reduced to 12 barges and on the lower Mississippi River, max tow configuration has been reduced from 40 barges to 25 or less. The flood conditions also increase wait times for shippers and increase the odds of demurrage fees.

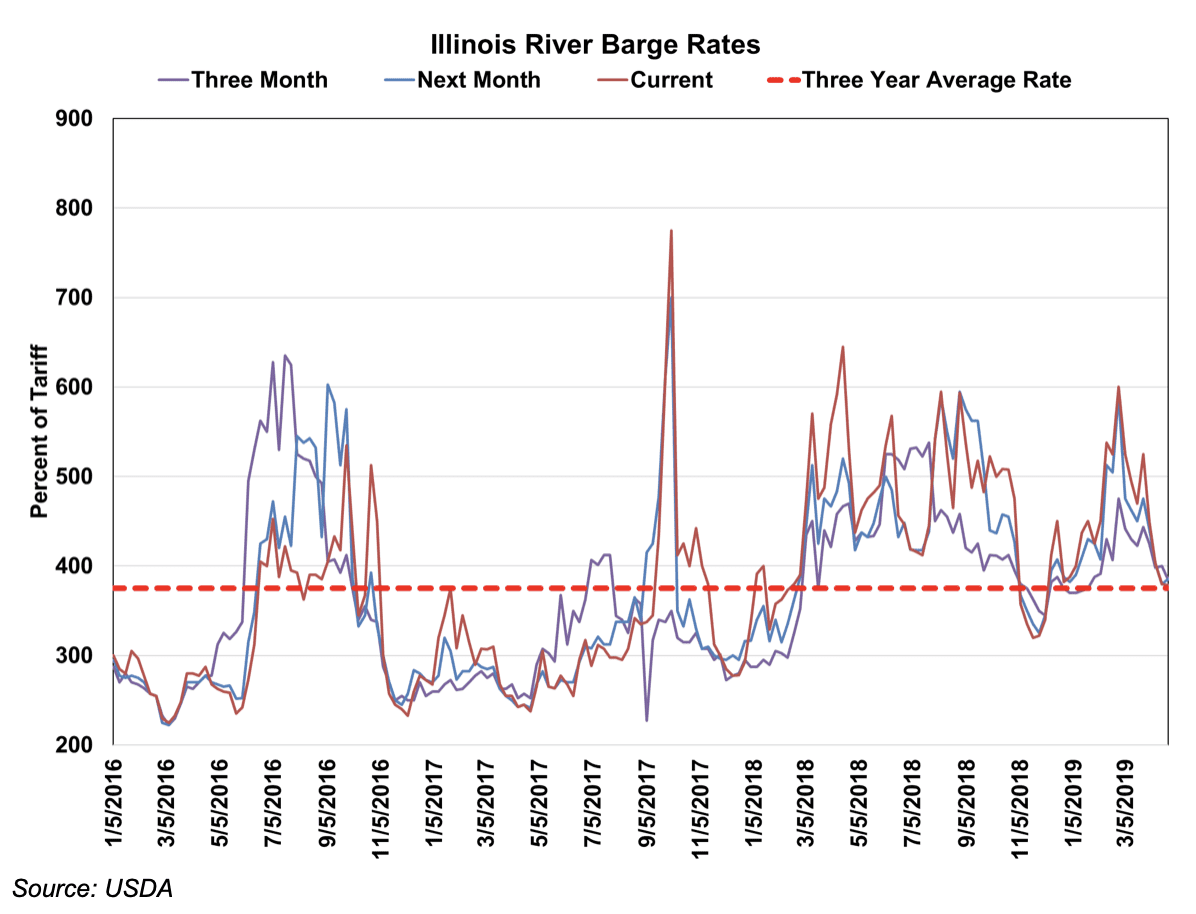

Currently, the lack of barge volume is offsetting the freight rate impact of barge capacity constraints. The forward three-month barge rate indicates that barge rates will continue to be slightly above the three-year average rate into summer. Barge rates in summer typically receive a boost from increased coal movements as air conditioners are cranked up.

It should be noted that the floods will also have a long-term impact on the barge industry and, in turn, farmers. In addition to a surplus supply of barges, the long-awaited multi-trillion dollar infrastructure plan that has been expected to help increase dry barge demand is still being discussed. For barge companies, the higher operational costs associated with the high-water conditions without a boost in barge rates will lead to more consolidation this year. The three-year average is basically the same rate received ten years ago. Over the last ten years, everything associated with the barge industry has increased in cost. The barge industry has undergone dramatic consolidation over the past 30 years and will continue to consolidate until the industry’s revenues and costs come into alignment.

Consolidation will eventually lead to higher barge rates. If crops need to be transported by barge, the resulting increase in transportation cost is two-fold as it forces country buyers to offer the farmer lower cash price bids and/or higher export FOB basis levels. A lower cash price reduces revenue and a higher free on board (FOB) basis makes the U.S. less competitive with the world soybean market. With approximately 60 percent of all grain inspected is exported through the Center Gulf, the impacts of the record flood will be felt in future years.