Sustainability becomes increasingly important to consumers in Southeast Asia (SEA) amidst shifts in agricultural markets.

Sustainability becomes increasingly important to consumers in Southeast Asia (SEA) amidst shifts in agricultural markets.

In the region, 58% of consumers are willing to invest time and money in supporting companies that value sustainability and 63% already factor sustainability concerns into their buying decisions, reported by the Kantar Group in the 2021 Foundational Study for Asia. Regard for sustainable practices, especially in agriculture, continues to rise in SEA at the same time oils and oilseeds markets face a perfect storm, as shared by industry leaders at the Second SEA Agricultural Leadership Summit.

In 2021, SEA faced structurally weak palm oil production, growing demand for biodiesel, poor canola harvests and low soybean crushing, shared Dr. Julian Conway McGill, agricultural economist, LMC International. This pressure has continued throughout the first three months of 2022 with Indonesian export controls, a surge in crude oil and fertilizer prices, and a halt to Ukrainian sunflower oil and grain exports.

“In February, Indonesia’s government introduced a Domestic Market Obligation (DMO), requiring exporters to sell 20% of their total export volume to the domestic market if they wish to receive export licenses” McGill said. “This was recently raised to 30%.”

This DMO comes at a time when oilseed crushing volume is already falling behind.

“China is still lagging behind its level of last year, while the U.S. is only just back to its early 2021 volume,” McGill shared. “Argentina, the big soybean oil exporter, is well ahead of its very poor 2020 performance, but will soon drop after its low crop.”

This year, shifting market demands alter the agricultural landscape globally. To start, world soybean meal demand growth has been pared back sharply versus February forecasts, said Emily French, founder, Global Ag Protein. It’s important to note soybean meal demand growth continues for the Silent Giant, or Rest of World (ROW) with China, Europe and the U.S. removed.

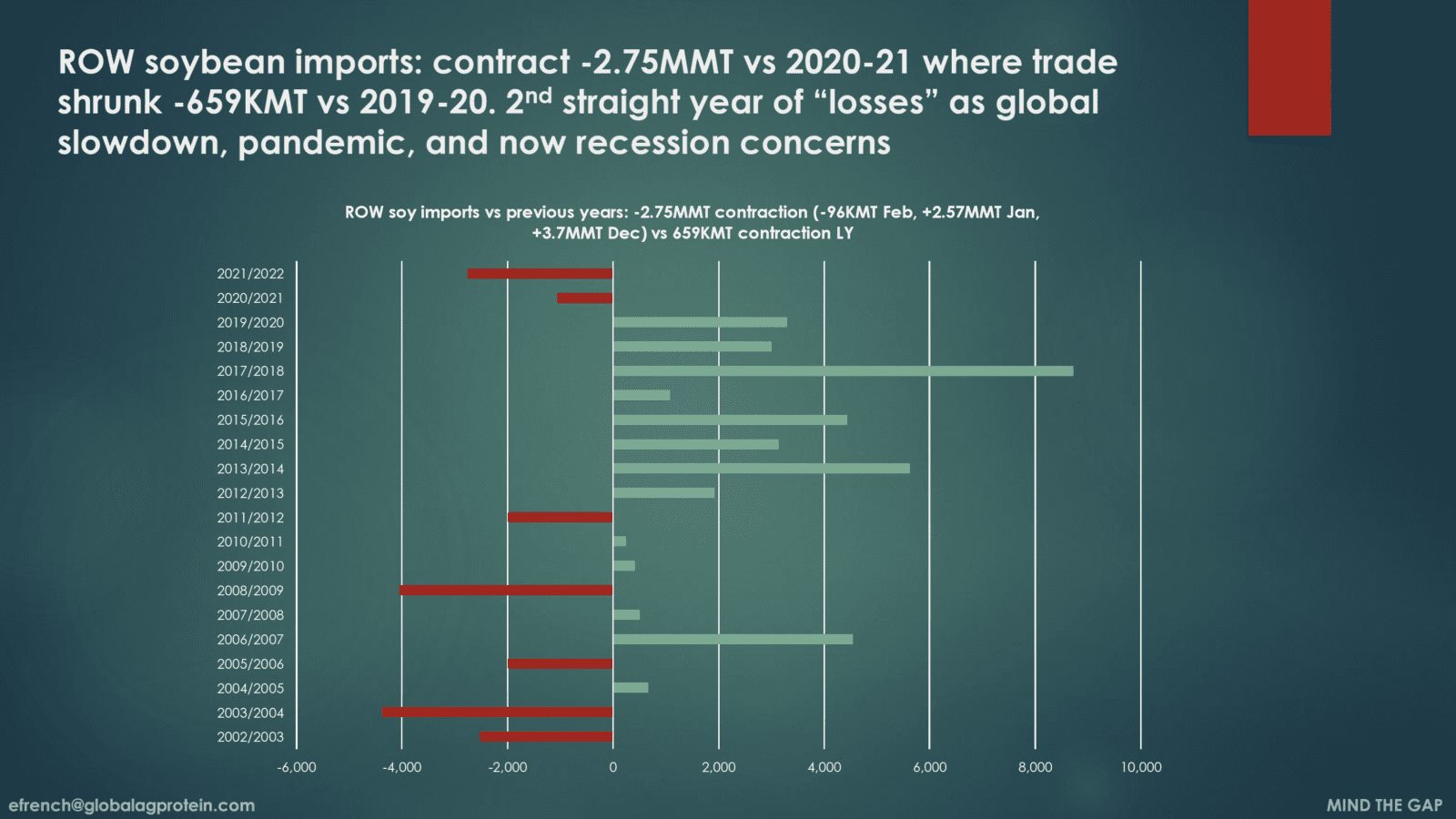

ROW soybean imports have experienced a -2.75 MMT contraction, marking the second year of losses. Soybean oil demand also faces a contraction for the first time since 2012-2013.

ROW soybean imports have experienced a -2.75 MMT contraction, marking the second year of losses. Soybean oil demand also faces a contraction for the first time since 2012-2013.

While these shifts cause uncertainty, they also present an opportunity for U.S. Soy as SEA consumers continue to prioritize sustainable practices.

“U.S. Soy farmers are the ultimate stewards of the land, combining decades of experience with the latest production technology,” shared Timothy Loh, Regional Director for SEA, USSEC. “70% of U.S. Soy acres use conservation tillage, .”

Water conservation and quality management also allow U.S. Soy farmers to increase water-use efficiency with irrigation systems, moisture sensors and water storage ponds. While a commitment to sustainability progress continues, U.S. Soy farmers have been making these strides for the past 40 years, and the environmental footprint of U.S. Soy is shrinking as a result.

Water conservation and quality management also allow U.S. Soy farmers to increase water-use efficiency with irrigation systems, moisture sensors and water storage ponds. While a commitment to sustainability progress continues, U.S. Soy farmers have been making these strides for the past 40 years, and the environmental footprint of U.S. Soy is shrinking as a result.

Customers in SEA have recognized the value of this commitment. In 2021, 47% of U.S. Soy shipments to the region were Sustainability Assurance Protocol (SSAP) verified. Up from 13% in 2019, Loh shared. Throughout market shifts in the region, customers can count on one constant: the reliable sustainability of U.S. Soy.

Learn more and stay tuned for future events in SEA at ussec.org.

- Partially funded by U.S. soybean farmers, their checkoff and the soy value chain.