Through education, technical training, workshops and seminars, U.S. Soy is changing the lives of people around the world. The U.S. soy industry is working to lay the foundation for increased protein by building production capacity in areas such as poultry and aquaculture. Maximizing efforts and available resources in these emerging markets helps increase demand for U.S. soybeans and soy products.

Global soybean imports have been growing for the past decade. And the U.S. Department of Agriculture (USDA) projects global soybean trade will increase by more than 30% in the next decade.[1] U.S. soybean farmers are positioned to meet the growing demand for a reliable supply of high-quality soy, thanks in part to checkoff investments in emerging markets.

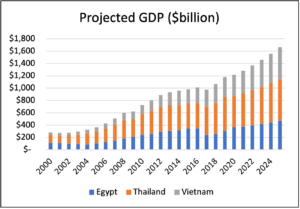

“U.S. soybean exports finished calendar year 2020 strong, on a record pace for both soybean and soybean meal exports,” says Mac Marshall, vice president of market intelligence for the U.S. Soybean Export Council (USSEC) and the United Soybean Board (USB). “We are seeing notable growth in sales to markets such as Egypt, Thailand and Vietnam, all countries with continued strength in economic growth.”

These three countries have all joined the top 10 U.S. export markets for whole soybeans based on USDA data, Marshall explains.

He notes that although the population in Thailand is projected to remain steady, Egypt and Vietnam both expect slow, steady population growth. But the growth of their buying power is projected to be much more dramatic. While that accounts for their growing soybean market, USSEC investments in these countries have demonstrated the value of meeting that growing demand with soybeans from the U.S.

“The U.S. inspected about 4.3 million metric tons of soybeans for export in February 2021, alone,” Marshall says. “Although China gets most of the attention as a market, more than 630,000 metric tons of those soybeans, or about 15%, were destined for Egypt, Thailand and Vietnam, according to U.S. Federal Grains Inspection Service data.”

Marshall adds that growing demand for and production of high-quality protein prompted significant growth in soybean crush capacity. All three of these countries have shifted their soy import preference from meal to whole soybeans.

“Diet is one of the first things that improves for a population as GDP grows,” he explains. “Soybeans play a valuable role in that improvement. Crushing soybeans to provide meal for poultry, livestock and aquaculture feed, as well as oil for cooking, efficiently meets demand for high-quality protein. And USSEC is providing valuable support in each market.”

Egypt: Home of the first Soy Excellence Center

“Over the past 20 years, Egypt’s chicken production has more than doubled to meet demand for domestic consumption,” Marshall says. “Egypt’s crush sector has advanced with the poultry sector. As its crush and feed sectors have evolved in recent years – especially since 2016 – Egypt has moved from primarily being a soybean meal importer to importing whole soybeans.”

During the same timeframe, aquaculture in Egypt grew more than 700%, and aquafeed demand has approached 2 million metric tons, with soy demand of 750,000 metric tons.[2]

Preference for U.S. soybeans has grown with Egypt’s crush industry. In 2017, Egypt grew from importing less than 1 million metric tons of U.S. soybeans to importing about 3.9 million metric tons, according to Marshall. Egypt now sources more than 80% of its soybean imports from the U.S.

“The U.S. proved to be a reliable, consistent shipper of soybeans,” explains Mousa Wakileh, regional representative for USSEC. “That was an important advantage for U.S. soy. The consistent quality of U.S. soy also appeals to customers.”

Since then, USSEC has intentionally invested in the Egyptian crush and feed industries, by introducing the In-Pond Raceway System to tilapia production, providing technical training for poultry, dairy and aquaculture experts, and building strong relationships.

On Sept. 24, 2019, Egypt became the location for the first Soy Excellence Center created by USSEC. A technical and policy pillar to advance the region’s soy supply chain, the Soy Excellence Center is a one-stop-shop for industry training, resources and education to all members of the soy value chain. Although in-person training hasn’t been possible during the past 9 months, an aquaculture production and management webinar marked the first anniversary of the Soy Excellence Center in 2020. It has become a model for the development of similar centers around the world.

“Though it’s been a complicated year, the Soy Excellence Center has been very productive, and it reinforces the value of U.S. soy,” Wakileh says. “Egypt has become the third largest soybean export market for U.S. soybeans, and soy exports to the entire region are growing. We are doing our part to feed Egypt’s growing poultry, aquaculture and dairy sectors, which in turn feed the thriving people of Egypt.”

Thailand: Demanding high-quality soybeans and technology

“Thailand’s chicken production has increased more than 70% since 2000, allowing exports to other markets in the region,” says Marshall. “Crush capacity increased in the past three years, driving demand for whole soybeans.”

That crush capacity also serves the large aquaculture industry. In fact, more than 40% of the world’s shrimp comes from Thailand.[3] It is one of Southeast Asia’s largest producers of full fat soybean meal.[4] In addition, Thailand has one of the largest, most sophisticated soy food and beverage industries. In 2018, per capita consumption of soy beverages was about 12 liters per year, second in the world.[5] Because of this strong demand, Thailand has been earmarked to become the location of a Soy Excellence Center for animal and aquaculture production to service the South Asia and Southeast Asia regions.

Thailand started importing significant amounts of U.S. soybean meal after industry leadership visited the U.S. in 2013. As Thailand’s crush capacity grew, Marshall notes that imports of whole U.S. soybeans grew from about 400,000 metric tons in 2013 to nearly 1.4 million metric tons in 2020. In 2018, nearly half of Thailand’s soybean imports came from the U.S., though in 2020 the U.S. supplied about one-third of their soybean needs. U.S. soybeans are also the feedstock of choice for full-fat soy in livestock rations.

“Importers and end-users in Thailand appreciate the quality and consistency of U.S. soybeans, backed by the assurance that the U.S. is a reliable and sustainable source,” says Timothy Loh, USSEC Regional Director for Southeast Asia. “So far in FY2021, Thailand has imported more than 1.1 million metric tons of U.S. soybeans, both for crush and feed uses.”

Many Thai buyers prioritize high protein content they get from U.S. soybeans to feed poultry. In the aquaculture sector, buyers value access to new technology like the In-Pond Raceway System and smart automated feeding systems through partnerships with USSEC.

“From their own experience, as well as support from USSEC, customers are well aware that they get better value from using U.S. soybeans and soybean meal in their feed production and livestock rations,” Loh says.

USSEC’s Dare to Compare campaign is helping to inform current and potential buyers of the true value of U.S. Soy, highlighting new research that shows the value of U.S. Soy’s nutritional profile, sustainability and refining characteristics.

While buyers have traditionally evaluated soy on crude protein alone, new research shows that metric is not the best indicator of how the crop will meet the nutritional needs of animals and aquaculture. Research has also shown country of origin makes a difference in the quality of soy. Genesis Feed Technologies’ Nutrient Value Calculator (NVC) helps buyers to form a true assessment of U.S. Soy, demonstrating the value of dollars and cents.

Vietnam: Rapidly growing crush industry feeds protein demand

“In 20 years, chicken production in Vietnam has increased over 260%, while pork production has more than doubled,” Marshall says. Vietnam also has a thriving aquaculture industry, producing 36% of the world’s catfish,[3] as well as many other types of fish, and even frogs.

Vietnam is the second-highest producer of pig feed and aquaculture feed in the Asia-Pacific region.[6] With the growth of these high-quality protein sectors, due in part to the rapidly expanding middle class, Vietnam is a fast-growing soy market.

“During the past decade, Vietnam has grown from having a virtually non-existent crush sector to becoming one of the top 10 destinations for whole U.S. soybeans,” Marshall adds. “The country went from crushing 0 soybeans in 2010 to crushing nearly 1.1 million metric tons today.”

He notes that Vietnam imported less than 200,000 metric tons of soybeans from the U.S. at that time. By 2020, they imported more than 1 million metric tons of U.S. soybeans.

With the rapid growth of these sectors came the need for knowledge, and USSEC stepped in to provide technical training and support. For example, the aquaculture industry has benefited from In-Pond Raceway Systems, support for cage farming and nutritional training. And, USSEC is helping the industry adapt to changes in the Mekong Delta. Similar efforts target pork and chicken production.

“Trade and technical services provided by USSEC help to clearly demonstrate to importers and end-users the higher value of U.S. soybean meal, helping the buyer to focus on what’s truly important in the valuation of meal — the critical amino acid values and metabolizable energy —rather than just looking at the crude protein values,” Loh says. “That’s the intrinsic value of U.S. Soy. In addition, buying from the U.S. also delivers extrinsic benefits to Vietnamese customers in the form of strong delivery system logistics and reliable contractual relationships with U.S. suppliers.”

These investments create a win-win for customers in these countries and U.S. soybean farmers. Marshall notes that exports and forward sales for U.S. soybeans in the 2020-2021 marketing year to these markets show significant growth from the previous year.

“Whole soybean exports from the U.S. through February 2021 were up 17% for Egypt, 24% for Thailand and 31% for Vietnam,” he says. “Forward sales anticipate increases of nearly 50% to Thailand, while Vietnam could nearly triple U.S. purchases and Egypt may buy nearly 350% more U.S. soybeans than last year. That’s a great sign for the health of their economies and the opportunities for U.S. soybean farmers to deliver the consistent, reliable, high-quality supply of soybeans they have become known for.”

References

[1] Baseline Projections, U.S. Department of Agriculture, February 16, 2021.

[2] Reeling ‘Em In, U.S. Soy – United Soybean Board, April 14, 2017.

[3] Around the World with U.S. Soy: Southeast Asia, U.S. Soybean Export Council, May 25, 2018.

[4] Thailand: An Up and Coming Power, South Dakota Soybean Checkoff, April 29, 2018.

[5] Asian Buyers Value U.S. Soy for Quality and Industry Support, U.S. Soybean Export Council, June 15, 2018.

[6] Survey Shows Continued Growth in Global Feed Production, AgriPulse for U.S. Soy, April 19, 2018.