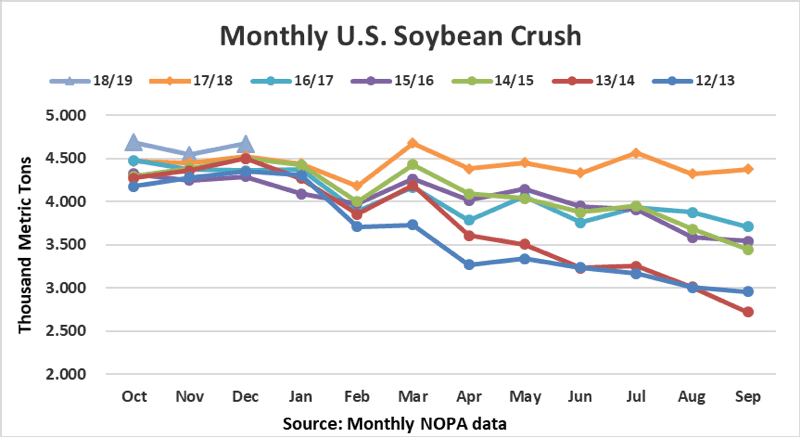

The National Oilseed Processors Association typically represents about 95 percent of the U.S. Soy processing industry. The group, referred to as NOPA, released their December crush and stocks report in mid-January. Members crushed about 4,674 tonnes (171.759 million bushels) of soybeans in December according to the group’s latest monthly release. This total is up 2.9 percent from November and is a new record for the month of December.

It was somewhat surprising to see member crush ramp up so dramatically after analysts were mildly disappointed by lower-than-expected November NOPA data and given the weakening margin structure for U.S. Soy processing in recent months. However, analysts’ miss this month could also suggest that members made up a higher percentage of the overall industry crush. Cumulative crush through the first quarter of the marketing year were up roughly 6 percent from the same time last year, which suggests that the U.S. Department of Agriculture’s (USDA) latest estimate for a 1 percent increase for the marketing year. This suggests that, barring a strong slowing in U.S. Soy processing once new crop South American supplies are available, USDA is likely understating its current projection for the 2018/19 marketing year.

NOPA members produced 2.008 billion lbs. of soybean oil and 4.018 million short tons of soybean meal in December. Based on the crush total, this calculated to be a soybean oil yield of 11.69 lbs. per bushel and a soybean meal yield of 46.79 lbs. per bushel. In its latest World Agricultural Supply and Demand Estimate (WASDE) report, USDA forecast that a bushel of soybeans in the 2018/19 marketing year will yield 11.55 lbs. of soybean oil and that same bushel would yield 46.26 lbs. of soybean meal. Data for the first quarter of the new marketing year suggests that a bushel of soybeans will produce more soybean oil and less soybean meal than USDA is projecting.

NOPA members reported holding soybean oil stocks of 1.498 billion lbs. as of December 31. While this was up 14 million lbs. from the end of November, it fell short of most analysts’ expectations. There was a rather wide range of expectations for this month’s soybean oil stocks that ranged from 1.491 billion lbs. on the low-end to 1.690 billion lbs. on the high-end, with an average guess of 1.571 billion lbs. The lower-than-expected stocks suggests that demand was robust at the end of the year. It is difficult to make an educated guess at this point as to whether the demand was domestic or foreign and whether it was for food or fuel at this point as the market awaits official December export and biodiesel data.