If you simply look at the numbers, there’s no doubt that U.S. soy has evolved from a support crop to a major player in the global marketplace. In 1991, the year the soy checkoff was created, the value of the U.S. soy crop was $11 billion. Fast forward to 2014 and the overall value had nearly quadrupled, to $40 billion.

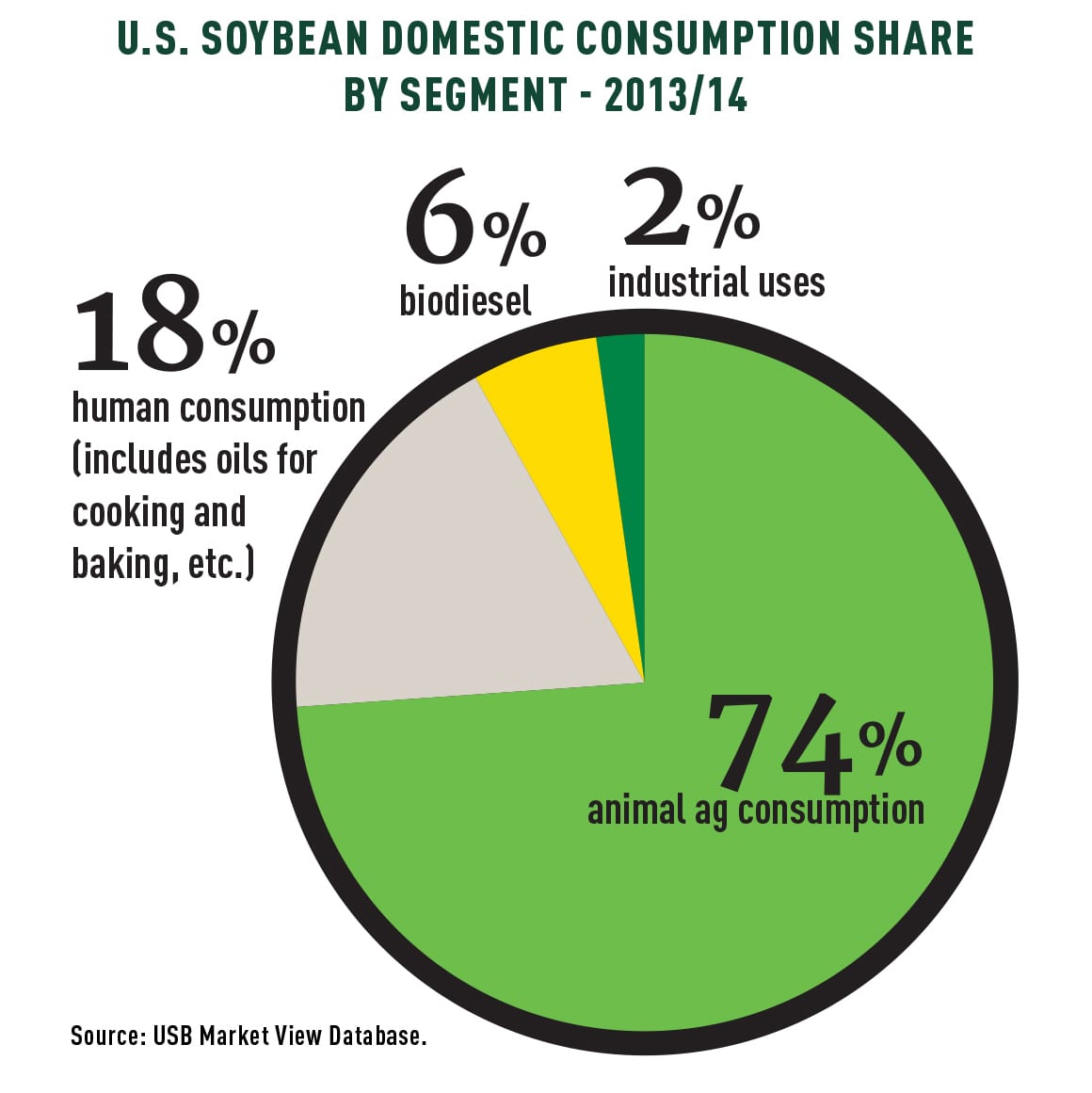

Those values illustrate the sharp increase in demand that has taken place due in part to the efforts of the checkoff. The checkoff conducts research and promotion among vital domestic and international customers who make feed, food, industrial products and more. Those activities create and expand markets for your crop.

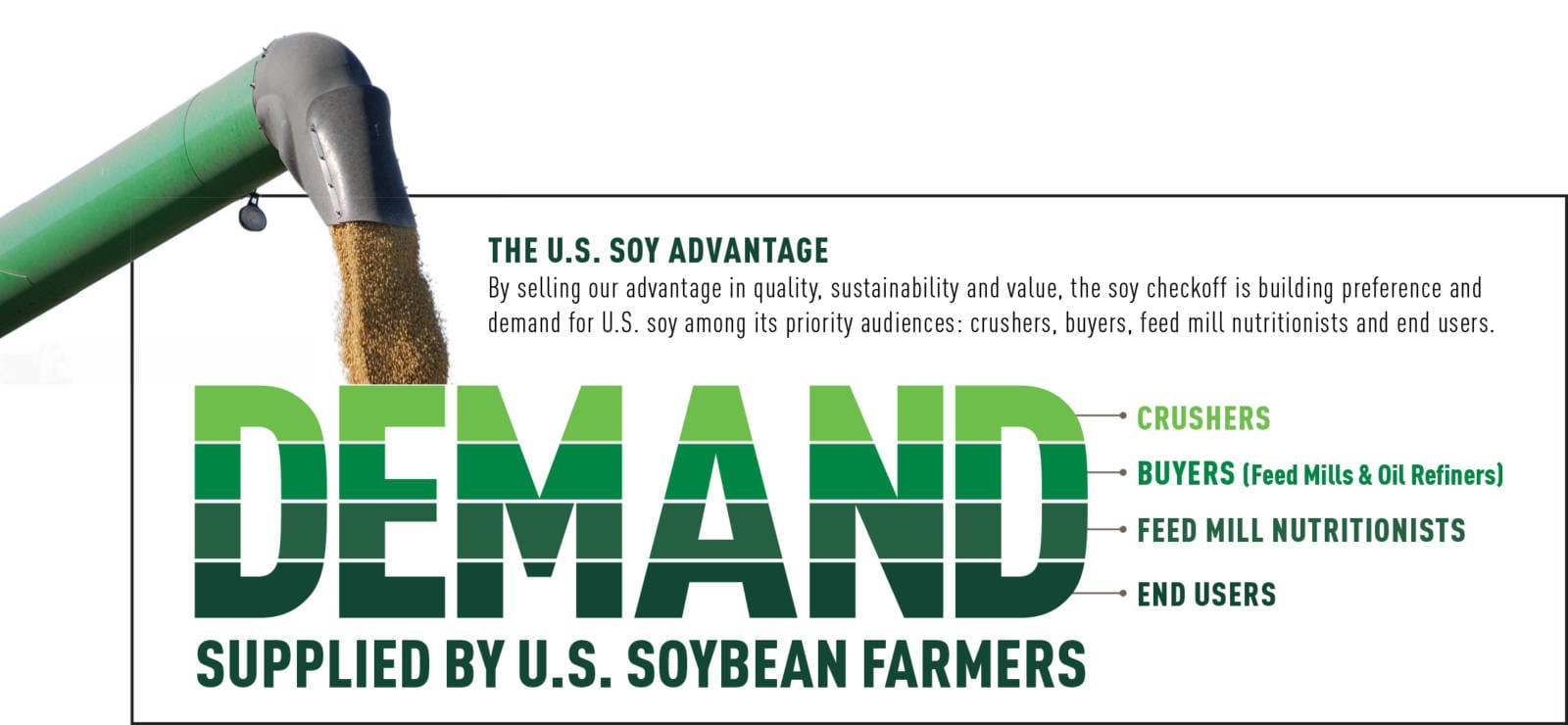

Demand drives profitability, and the checkoff aims to stimulate demand growth through its Long-Range Strategic Plan by defining and promoting the U.S. Soy Advantage. Based on soy’s component quality, sustainability and value, that advantage builds preference for U.S. soy in the face of competitive threats both domestically and abroad.

U.S. soybean farmers have built a strong advantage over their competitors around the world by consistently growing a large supply of high-quality, sustainable soy. As end users have more choices, however, the importance of high yields is being replaced by the need for high value. The checkoff must keep improving U.S. soy, keeping products on the cutting edge of innovation and making sure they meet end-user needs.

“The world has moved to a much more competitive environment, and the days of ‘just grow more of it’ have long passed us by,” says David Tillman, vice president of sales and marketing at Stratas Foods, a leading supplier of oils to the food-service industry. “In today’s world, the industry has to continue to discover ways to add value not only in the end product, but also along the way.”

Stratas is very familiar with one way the checkoff has done that – high oleic soybean oil. Rather than watch soybean oil demand fall when the U.S. Food and Drug Administration decided to phase out partially hydrogenated soybean oil, the checkoff helped to make the high oleic solution available to farmers quickly. When usage and acreage goals are met, high oleic soybeans will add an estimated 46 cents per bushel for all U.S. soybean farmers.

Innovation must be a constant in order to make sure U.S. soy meets all end user needs, including the demand for high-quality meal and sustainability. Without a steady stream of new technology, the U.S. soy industry risks losing market share to competitors.

Through its Long-Range Strategic Plan, the United Soybean Board (USB) is making sure that never happens. USB is more focused than ever on increasing demand. In fact, of the nine goals set in this plan, five are focused on building demand. It’s this blueprint for building demand that will help to ensure a strong and profitable future for U.S. soybean farmers.

Meeting end users’ needs

One of the primary ways the checkoff continues to maximize demand is by looking at the challenges that its end users face and coming up with solutions. Those solutions add value for customers and keep them coming back for more.

“Taking a customized approach to our end users helps us to build preference for U.S. soybeans,” says Lewis Bainbridge, a South Dakota soybean farmer who leads demand-building activities for USB. “We aren’t operating in a one-size-fits-all market. Maintaining and extending our reputation as a trusted supplier is key to our future success.”

For example, Perdue AgriBusiness finds great value in the constituent value and the quality of soybean meal and oil.

“Farmers are raising beans for yield, and sometimes these components are not appreciated, and that undermines the value of the soybean,” says Perdue Senior Vice President of North American Soy Sales and Merchandising Gary Cordier. “When you’ve got competing ingredients – DDGS, canola, soybeans from international markets – U.S. soybean farmers have to stand apart, head and shoulders above other suppliers around the world. Customers are looking for that.”

As a processor selling both soybean meal and oil, Perdue represents two important demand groups, which is why its preference for U.S. soy is so important to the checkoff.

Improving component quality to add more value to U.S. soy is a focus of the Long-Range Strategic Plan because U.S. soybean protein levels have been in decline over the last 20 years. However, extensive global research supports that U.S. soybean and soybean meal products contain more nutrients than soybean meal of other origins. U.S. soy customers enjoy the oilseed’s superior amino acid content and amino acid profile; increased metabolizable energy content due to higher sugar levels, lower fiber content and improved amino acid digestibility; higher total phosphorus content; and greater uniformity of nutrients.

Building markets

Today, more and more customers are asking to have their raw materials sustainably sourced – a demand that U.S. soybean farmers are able to meet. Through the U.S. Soybean Sustainability Assurance Protocol (SSAP), sustainable soybean production is documented at a national scale with a third-party audited and certified aggregate approach. Goals for continuous improvement outlined in the SSAP reinforce to customers the dedication soybean farmers have to continuous improvement.

“This protocol was developed to match our practices to what our customers want to know about. Our international customers like the SSAP, and that means that U.S. soybean farmers should like the SSAP as well, since it helps us with stability in the form of continued access to world markets,” says Larry Marek, an Iowa soybean farmer who helps oversee strategy for USB.

To date, more than 4.3 million metric tons of certified-sustainable U.S. soy have been shipped to important markets like China, Vietnam and Japan.

International markets continue to be critically important as an outlet for the huge supply of soybeans produced in the U.S. each year.

In the past 25 years, China has gone from a competitor of the U.S. soybean industry to its largest customer. In 2014, China imported $14 billion worth of U.S. soy, which is more than the total value of the entire 1991 U.S. soybean crop. And a recent U.S. Soybean Export Council (USSEC) report indicates annual soybean imports in China will increase by between 110 million and 183 million bushels per year for the next five years.

Even with China’s increase in soy imports, it is imperative for soybean demand in other regions around the world to continue growing to diversify demand opportunities for U.S. soy.

But, sustainability is just one way the checkoff builds international demand.

In the Long-Range Strategic Plan, building demand for soy protein for use in human food in Indonesia and Taiwan is identified as an opportunity. And promoting U.S. meat and poultry abroad increases soy demand for use in animal feed domestically.

Researching and commercializing new uses

Industrial end users also leverage the sustainability of your crop. That will continue, as USB’s Long-Range Strategic Plan includes a goal to increase industrial preference for U.S. soy even more.

Soybean meal and oil are readily available, sustainable alternatives to petroleum-based ingredients used in adhesives, plastics, coatings, lubricants, rubber and more. And biodiesel serves as a sustainable transportation fuel and heating option.

Detroit’s Big Three Automakers – Ford, General Motors and Fiat Chrysler – have supported high biodiesel blends for nearly a decade. And while biodiesel has been a great generator of demand for U.S. soy, the new uses don’t stop there. The checkoff partners with manufacturers, such as Ford and Goodyear, to commercialize new soy-based products, giving farmers and others even more opportunities to buy products that contain U.S. soy.

“Ford first partnered with the soy checkoff in 2002 to develop soy-based foams for automotive seating, and our partnership continues to grow,” says Debbie Mielewski, Ford’s senior technical leader, materials sustainability. “The checkoff introduces us to other smart people with a common goal of increasing sustainability and utilizing soy in innovative ways. Soy seating meets or exceeds every performance and durability requirement. Ford has it in millions of vehicles every year, and I hope to see it used extensively in many other industries, including the mattress, furniture and agricultural equipment industries.”

Driving demand with the U.S. Soy Advantage

Regardless of the end user, rest assured that it is the U.S. Soy Advantage – quality, sustainability and value – that will continue to add demand for your products. And it is the soy checkoff that will continue to keep U.S. soy top of mind with key customer audiences and how soy can better solve their business challenges.

“Demand for our crop is one of the fundamental reasons why the checkoff was created,” says Bainbridge. “I’m looking forward to the work at the end of the value chain, where we secure demand for our product on behalf of U.S. soybean farmers and maximize our profitability.”