Plantings and Crop Ratings

The 2019 U.S. soybean crop has been one that many growers likely won’t soon forget. According to the U.S. Department of Agriculture’s (USDA) March intentions survey, U.S. farmers intended to seed 34.244 million hectares to soybeans in 2019, down 5.1% from 2018. However, adverse weather conditions prompted many farmers to push the limits of their equipment and manpower to get soybean seeds into saturated field conditions within the typical planting window, thus preventing these planting expectations from being met. According to USDA’s weekly Crop Progress reports, sowings lagged behind the normal pace in each of the eleven reporting weeks. By late May, just 29% of the crop had been planted, compared to 74% the previous year.

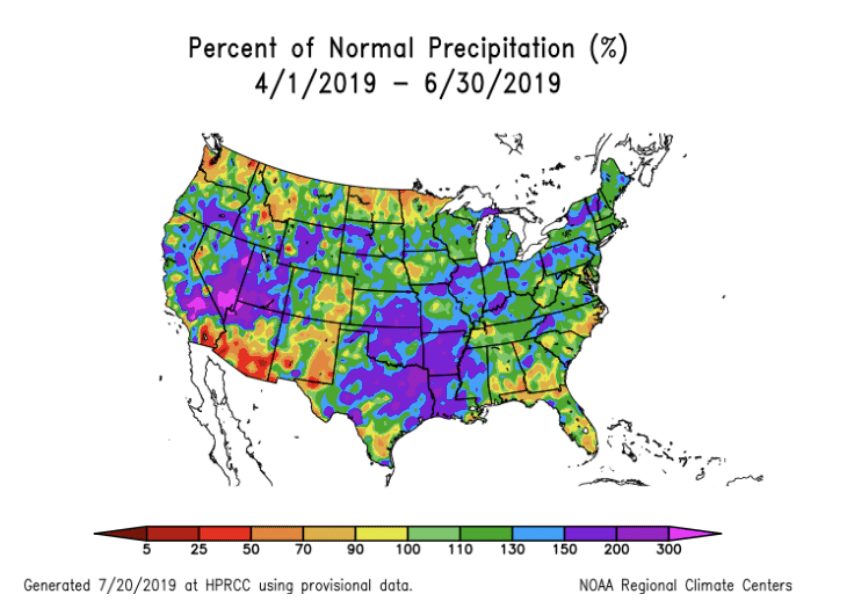

Weather was the limiting factor in farmers’ ability to plant summer crops in 2019 as many areas received nearly double their typical rainfall totals during the typical planting window of April through June. The following map highlights the pockets of excessive moisture during that period with pockets of light blue indicating moisture levels at 130% to 150% of normal while the purple regions indicate moisture levels of 150% to 200% of normal. These areas overlay with many of the key soybean production areas. To put this into perspective, the following states are shown with their respective rankings in terms of 2018 soybean production: Missouri (7th), Illinois (1st), Indiana (4th) and Ohio (6th), along with adjoining areas in Iowa (2nd), Nebraska (5th), South Dakota (8th) and southern Minnesota (3rd). As a result of the wet conditions at plantings, USDA’s latest estimate of the actual soybean area released in October fell short of the March intentions by 9.6% at 30.941 million hectares.

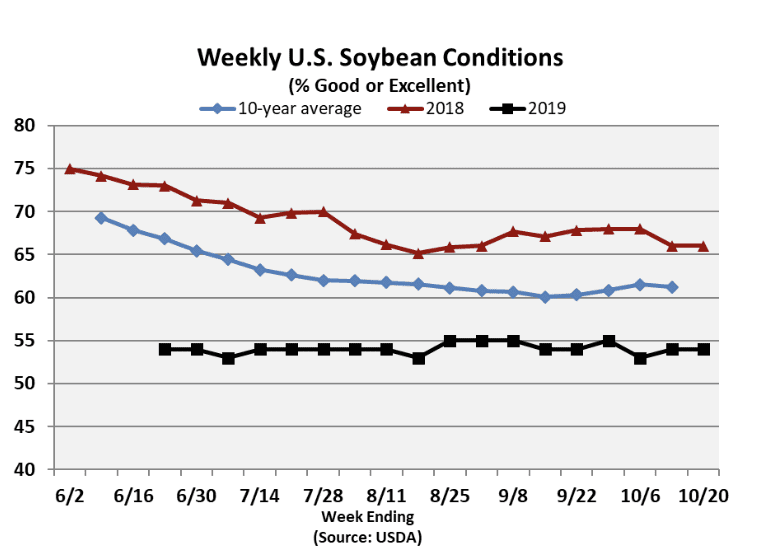

Not only were farmers delayed getting much of the crop into the ground on time, once plants emerged, the perceived condition ratings of the 2019 U.S. soybeans were well below recent years. The key metric followed by the U.S. market is the portion of the crop rated to be perceived in either ‘Good’ or ‘Excellent’ (G/E) condition. The initial reading for the 2019 crop came in at 54% G/E on June 23rd. This compared with 73% G/E in 2018 and was the lowest rating for the week since 53% was reported in 2012. The following chart shows 2019 ratings on the black line and highlights the considerable disparity in condition ratings for soybeans between the 2019 crop and recent years.

Harvest Progress

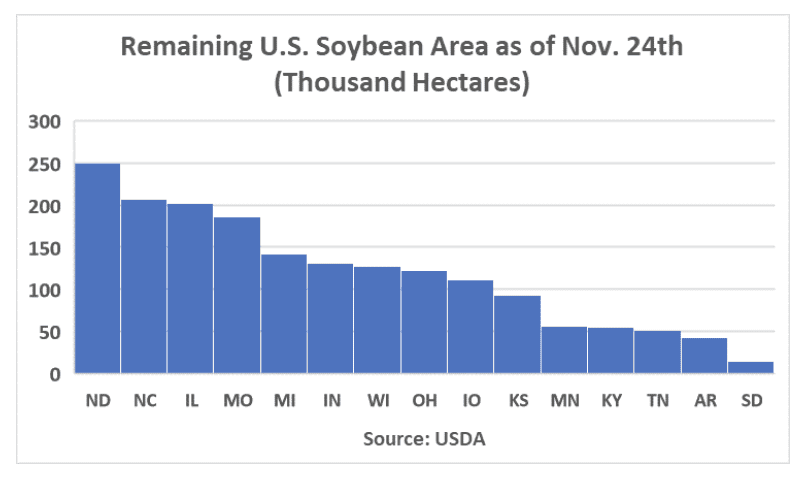

According to USDA, the 2019 U.S. soybean harvest advanced by three percentage points to reach 94% as of Sunday, November 24th. National harvest reports did not begin until the last full week of September, which is two weeks behind last year’s pace and had not caught up to equaling last year’s progress of 91% until November 17th. The extended harvest season this year provides no historical comparison as farmer results have typically been completed by the third Sunday in November. USDA procedures are such that harvest will be reported until the national campaign reaches the 95% mark, which suggests that one final update is to be issued the first Monday of December. Based on the November 24 update, farmers have the most unharvested fields in the states of North Carolina (33%), Michigan (20%), Wisconsin (18%), North Dakota (11%) and Missouri (9%). With approximately 1.8 million hectares of the 30.941 million hectares planted that are remaining to be harvested, there is little concern for the remaining soybean supplies. Based on USDA’s latest planted area estimates, the following chart shows that about 249,000 hectares were not yet harvested in North Dakota, followed by 207,000 hectares in North Carolina, 202,000 hectares in Illinois and about 186,000 hectares in Missouri.

USDA Yield Components

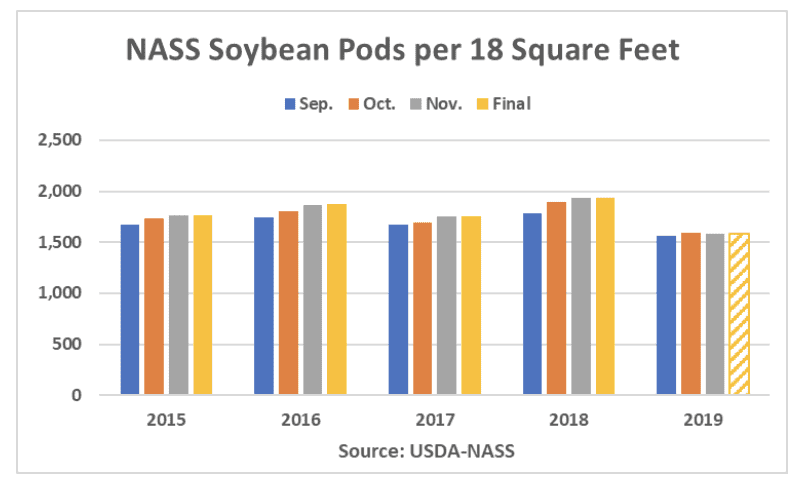

USDA’s National Agricultural Statistics Service (NASS) Crop Production report released on November 8th provided the third installment of the objective yield data of the 2019 growing season for eleven soybean-producing states. According to NASS, “Randomly selected plots in soybean fields are visited monthly from September through harvest to obtain specific counts and measurements.” The key component recorded from each field is the number of pods with beans counted per 18 square feet. The second component of the output calculation, the implied pod weight, is not captured directly by NASS but can be calculated utilizing the known pod counts along with agency’s state-level yield estimates.

Overall pod counts were estimated at 1,582 per 18 square feet in the November Crop Production report. This was off 11 pods from October, but was improved by 21 from the initial September reading. Surveyed fields in top 2018 soybean producer Illinois were shown to have had reduced pod counts of 1,601. This was off 95 from September, off 82 from October and compared with a final reading of 2,264 in 2018. In Iowa, the second largest soybean producing state in 2018, pod counts rose 59 from September and were 18 higher than in October at 1,660. This also compares poorly with 2,097 in 2018. These mixed changes throughout the final production and harvest periods highlight the overall variability seen across areas of the U.S. growing regions in 2019, but the overarching theme of these data is lower pod counts when compared with 2018 and previous years. If the average changes from November to the final readings from 2015 to 2018 are applied to the latest reported datapoint, then the final pod count will rise 3 from November to reach 1,585.

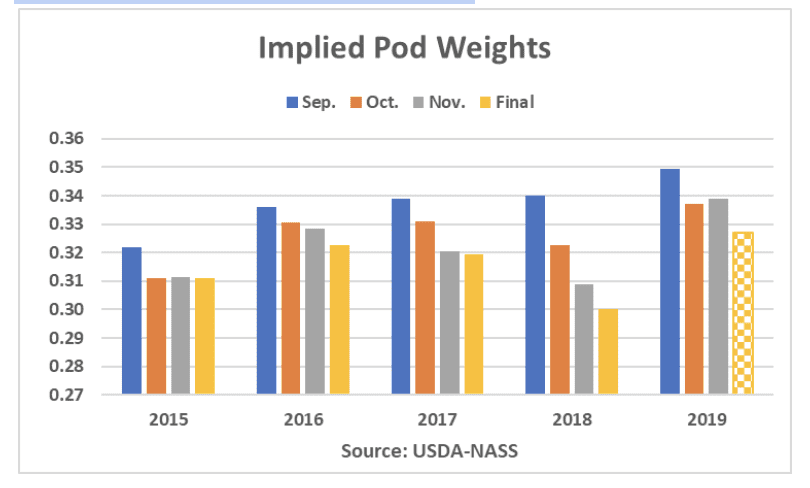

According to NASS, the calculation for solving for the implied pod weight is to take the estimated yield divided by the number of pods per 18 square feet and divided again by a factor of 0.0899. The history of monthly implied pod weights is found in the following chart and shows that weights implied for the 2019 crop began at their highest levels in recent history, before falling near previous September highs but remained well above the next highest final level near 0.32 grams per pod in 2016. In each of the previous four years, the final implied pod weight has fallen on average by 0.012 grams per pod which would equate to a 2019 final reading near 0.327 grams per pod as shown as the checkered column for the final reading in the 2019 grouping. Assuming that there are to be no material changes in the number of pods per 18 square feet surveyed, this would imply that final yields would be reduced by 0.6% from the November projection.

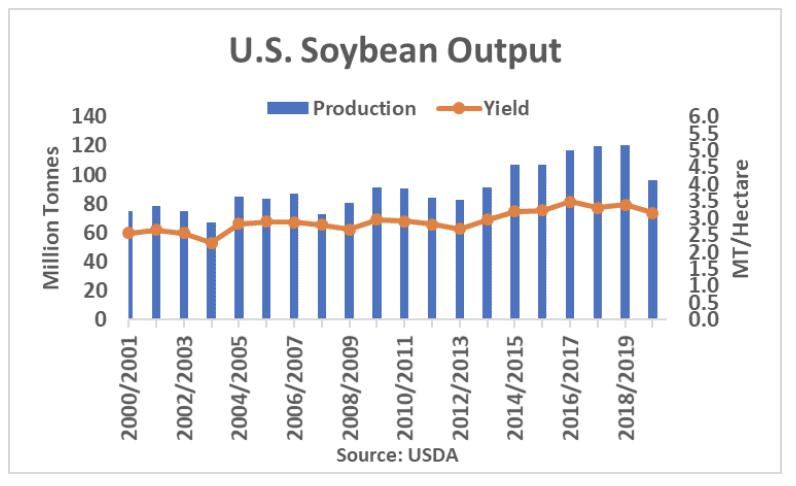

Pod counts and implied pod weights are the central two variables that are entered into USDA’s objective yield calculations. Based on these data, the agency projected the 2019 U.S. soybean yield in November at 3.16 tonnes per hectare for a crop of 96.615 million tonnes. This was essentially unchanged from the October report, and compared with 120.515 million tonnes collected in 2018 with a yield of 3.40 tonnes per hectare. On average, analysts polled ahead of the report were looking at a smaller soybean crop of about 95.6 million tonnes, which was down from the October average trade guess of about 97.2 million tonnes. Going back to the objective yield data outlined above, assuming no changes to USDA’s latest harvested area projection, the recent historical relationship suggests that the final 2019 U.S. soybean yield will slip to 3.14 tonnes per hectare resulting in a crop of 96.100 million tonnes. As it currently stands, USDA’s latest estimate of the 2019 U.S. soybean crop would be the smallest since 91.363 million tonnes was produced in 2013, which happens to coincide with the last time that the national average yield fell below 3.0 tonnes per hectare.

Conclusions

Larger-than-expected production estimates from USDA reflect two themes that are central to the 2019 U.S. soybean growing season. First of all, this year is a testament to the persistence of U.S. farmers, many of whom fought Mother Nature in the spring and early summer of 2019 to get soybean seeds planted, and in some cases re-planted, in order to collect a sizeable harvest this fall. This larger-than-expected production figure has in turn provided global buyers of U.S. soybeans with considerably lower prices than many analysts had predicted earlier this summer when plantings and output forecasts were substantially lower early in the summer months. The results of farmers’ hard work in the 2019 growing season will provide ample opportunities for the U.S. to again help feed the growing needs of the global marketplace.

USDA is scheduled to publish its next and “final” update to the 2019 soybean crop in January and will include any required revisions again late in September 2020 once the 2019 crop size is adjusted following the reporting of all of the known demand components and marketing-year ending stocks.