The first North Asia Soyfood Report from the U.S. Soybean Export Council, or USSEC, provides a comprehensive review of current market factors impacting the soy food market across China, Japan, Korea and Taiwan. The report, funded in part by the soy checkoff, offers unique perspective on the soy food market in a region where soy is considered a cultural staple.

“USSEC’s in-country staff and market experts share both broad and deep insight into current factors impacting soy food markets with growing demand for both traditional soy foods and new plant-based protein options,” says Will McNair, director of oil and soy food programs and deputy director of Northeast Asia for USSEC. “The report explores factors from sustainability and consumption to policy and labeling to give the industry a holistic picture.”

The report details trends in the consumption of traditional soy products like tofu, natto and soy drinks. It also delves into new trends focused on plant-based meat and other protein products, consumer interest in sustainability and country-specific regulations.

A few examples highlight the breadth of the report’s content.

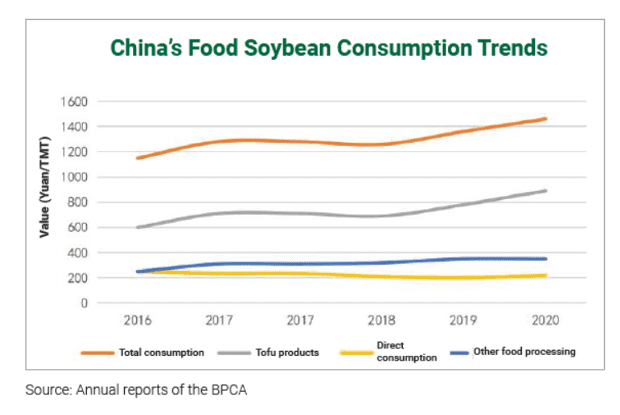

- Increasing tofu consumption drives overall soy food demand in China, where interest in plant-based yogurt, including soy yogurt, also is growing.

- Japanese consumers show increasing focus on sustainability, while the local soy food industry adheres to specific standards for soy products.

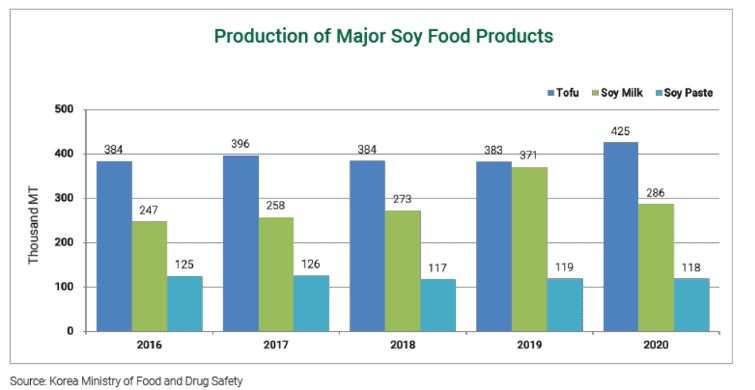

- In Korea, trade policy directly influences opportunities for U.S. Soy, as production of major soy food categories like tofu and soy milk remains strong.

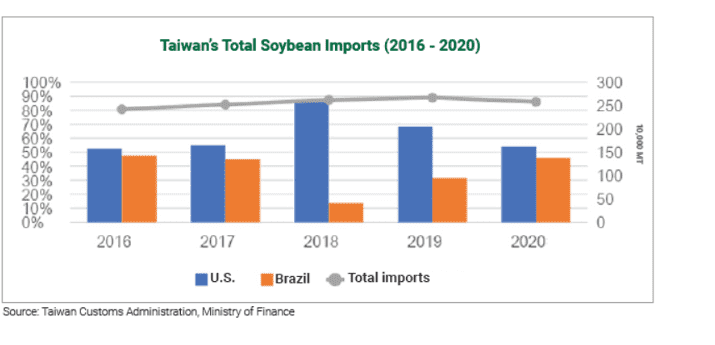

- Overall, soybean imports have been steady as the soy food industry explores options to find value for okara, currently considered a waste product from tofu and soy milk production.

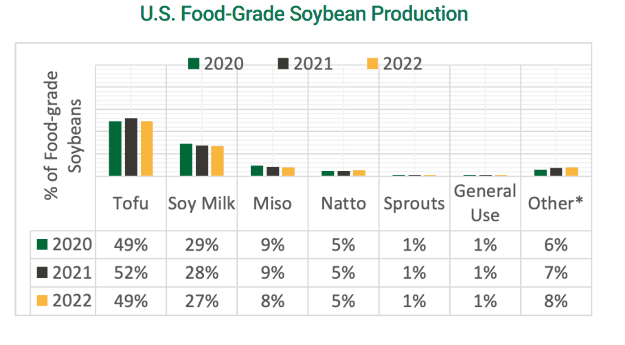

- Soy food bean production in North America reflects demand in North Asia. Nearly half the soy food beans grown in the U.S. become tofu, and more than a quarter of them are destined for soy milk.

“Soy food manufacturers in North Asia need reliable, sustainable sources of high-quality soybeans,” McNair says. “U.S. Soy is well positioned to meet their needs, especially as U.S. farmers continue to improve the quality and sustainability of soybean production.”

He believes the report delivers valuable information about soy food opportunities in North Asia for every link in the soy food supply chain. Better understanding of the market environment can help the soy food industry, from manufacturers and imports to farmers, work together to meet consumer expectations.

“Our team helps make sense of market trends and the factors influencing,” he continues. “The North Asia Soyfood Report serves as a planning resource for the entire industry, especially those connected to markets in China, Japan, Korea and Taiwan.”

This story was partially funded by U.S. Soy farmers, their checkoff and the soy value chain.