Earlier this summer, we looked at Nigeria as a potential source of growth for U.S. soybean imports after private investments in domestic feed and livestock infrastructure. In the Foreign Agricultural Service (FAS) Post’s Oilseeds and Products Annual report released in early August, it was reported that Nigeria’s government has put the wheels in motion to policies to invest upwards of $500 million to expand the country’s palm production. The investment comes as domestic food demand for palm oil and palm kernel oil grows, and the rising output may help to curb demand for imports from Southeast Asia and other neighboring African producers.

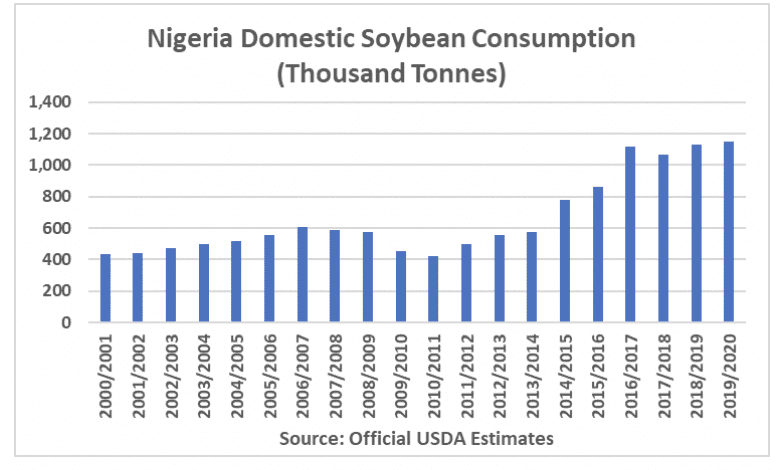

In addition to investment in the palm sector, there have also been efforts to help bolster Nigeria’s own soybean output via on-farm trainings and through incentives to increase efficiency through improving production techniques. Despite these efforts, however, the Post still anticipates that Nigeria will see greater demand for imported soybeans as output growth is not expected to meet demand. The Post projects that Nigerian farmers will see domestic soybean output rise 9.1% to 1.15 million tonnes in 2019/20 with import demand seen rising 31% from latest estimates for the current marketing year to 85,000 tonnes in 2019/20. Larger supplies are seen by the Post as increasing soybean crush totals above the U.S. Department of Agriculture’s (USDA) official forecasts of 660,000 and 700,000 tonnes in the 2018/19 and 2019/20 marketing years. This compares with USDA’s July projections of 650,000 and 675,000 tonnes, respectively. In addition to growing crush, the Post also sees domestic feed demand at 170,000 compared with USDA’s official projection of 147,000 tonnes. USDA’s official forecast points to Nigeria’s domestic soybean consumption rising 20,000 tonnes in 2019/20 to reach 1.147 million tonnes.

The Post noted that Nigeria has recently relied on soybean imports from the U.S., Great Britain, India, and Thailand to supplement domestic supplies. The outlook for ample U.S. soybeans, combined with concerns for oilseed production shortfalls both in India (following the relatively poor monsoon) and the E.U. (following bouts of excessive summertime heat), could result in buyers finding U.S. soybeans the most competitive means to fulfill growing demand.