The global reach of COVID-19 virus has created unique circumstances that will bring change, according to Emily French, managing director at ConsiliAgra. French discussed the implications of black swan events on the global soy marketplace during the U.S. Soy Connection: Global Digital Conference and Situation Report.

“There’s no question that it’s agriculture that makes the world go around,” she said. “Global agriculture continues to do what it does best, and that is feed and nurture the world.”

French explored the pre- and post-COVID-19 global markets for soybeans, soybean meal and soybean oil. She explained that market prices are range bound, regardless of events like the coronavirus, because of demand uncertainty, the potential for supply shock, desire to limit risk and the U.S. acting as a transparent backstop for world prices.

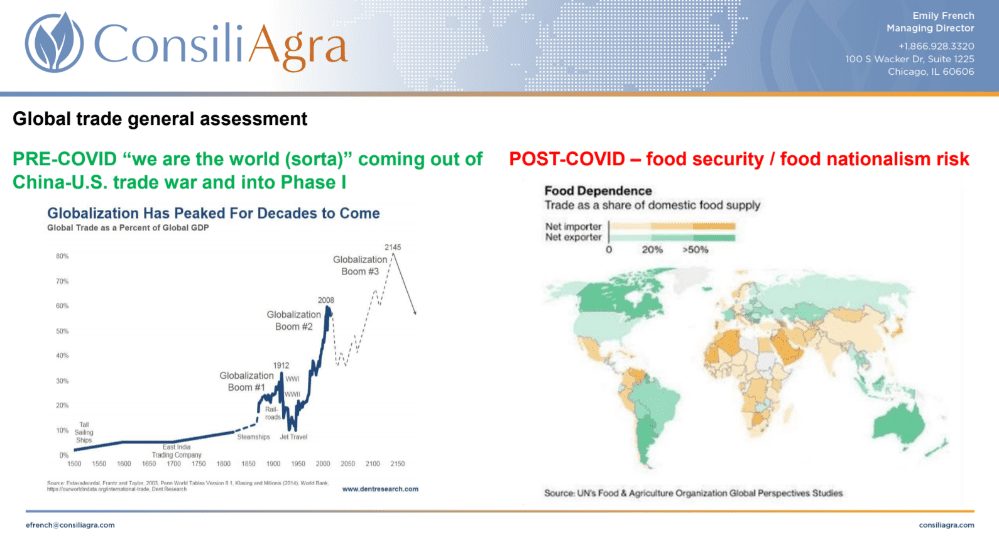

“Pre-COVID, it felt like we were coming out of the U.S-China trade war,” she said “We’re recovering and moving back into a world where globalization is good. But post-COVID, the focus switched to where these commodities are physically located and what export countries are at risk of export restrictions or food security or vulnerabilities. We’ve seen the market become much more sensitive to any sort of supply disruptions.”

According to French, the coronavirus pandemic has raised the question of the actual size of world stocks should there be a supply chain breakdown.

“We expect to see a big shift from U.S. storing soybeans to China storing soybeans,” she explained. “The risk as a world importer is that China will be carrying more of the world’s soy stocks and those soy stocks will not likely be re-exported.”

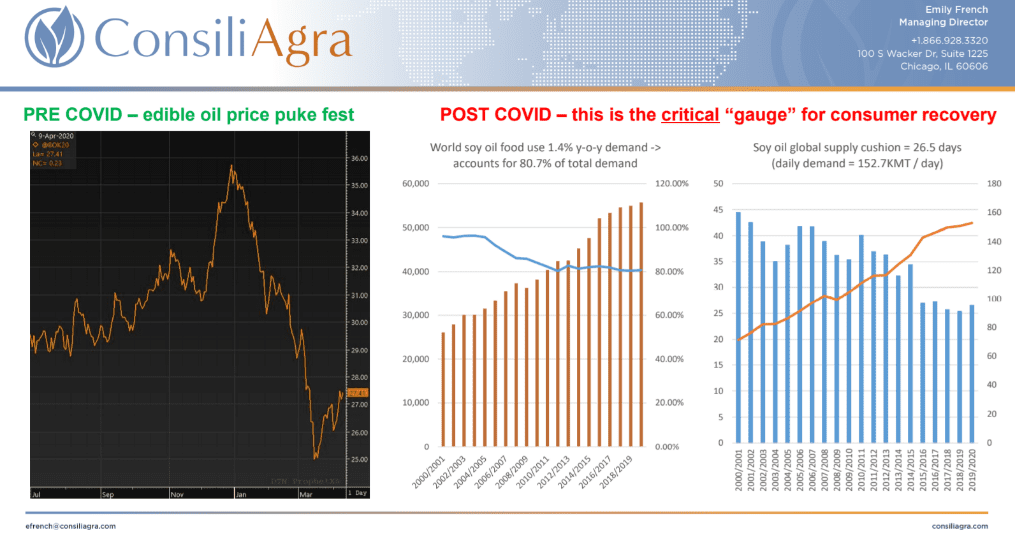

She noted that soybean oil prices fell dramatically because of huge drop in consumer demand for edible oil and a drop in energy needs for renewable fuel, all due to the COVID-19 pandemic. French considers soybean oil demand a gauge for consumer recovery in the months ahead.

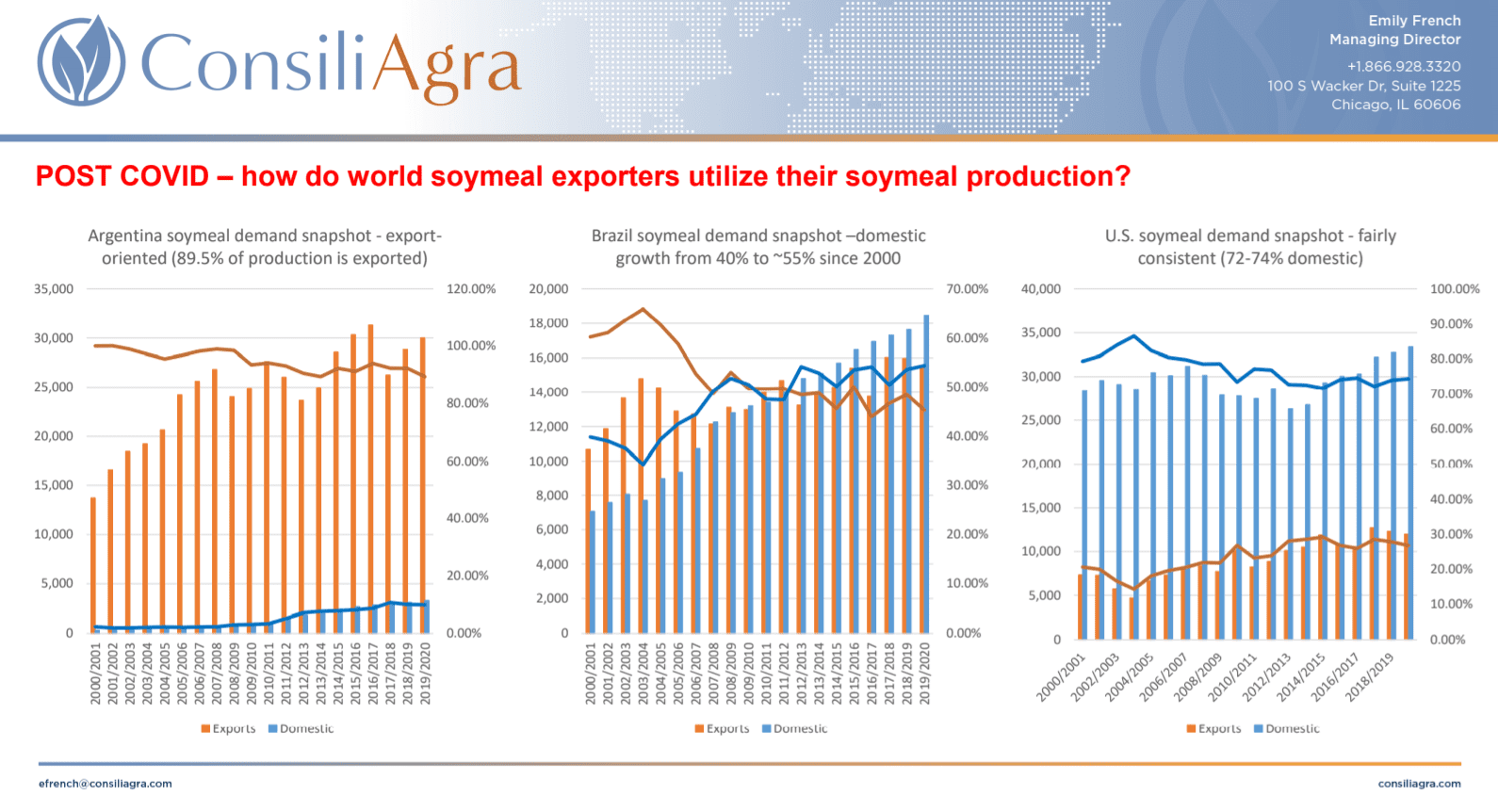

For soybean meal, African swine fever (ASF) had already destroyed some demand.

“The world market was moving through that,” she said. “Despite this major demand headwind, the global meal supply cushion is just over 16 days, which is why the meal market can become volatile if there’s an issue. This is the smallest supply cushion since the 2008 to 2010 period.”

She also explored the implications of the collapse of the U.S. ethanol market and drop in dried distillers grain available for feed on soybean meal demand.

While China drove much of the soy market before COVID-19, French said that currency is now driving the market. With that in mind, importers will need to adjust to the changes wrought by the global impact of this event. However, she noted that the world needs China’s demand to recover.

“The value of relationships of clear and concise communication and transparency has never been more evident,” she concluded. “The value of free and reciprocal trade has never been more evident. The value of agriculture and its food systems in addition to the world health care system has never been more evident.”

The U.S. plays a vital role in this global market, and as others emphasized during the conference, U.S. Soy is open for business.