Gustavo Idígoras, president of Argentina’s oilseed processing group CIARA, estimated that the country’s soybean crush would fall by 15 percent in 2019 as increased competition from U.S. soybean products have eroded the country export market share. Idígoras told news wires in late May that sales of soybean meal and soybean oil, the key components of processed soybeans, had fallen by one-third due to increased competition from the U.S.

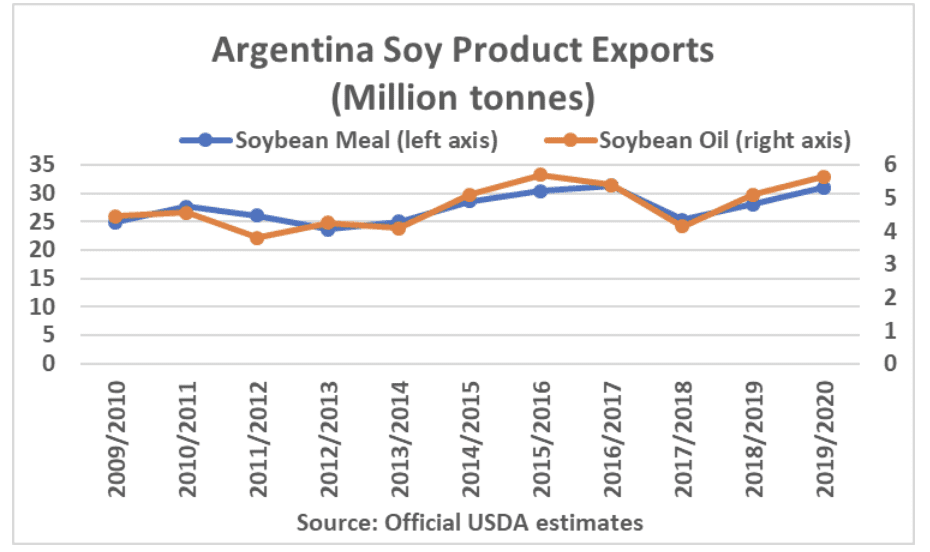

The U.S. Department of Agriculture (USDA), in its May World Agricultural Supply & Demand Estimates (WASDE) report, indicated that Argentina’s demand for soybean crush would rise to 42 million tonnes in the 2018/19 marketing year, up nearly 5.1 million tonnes from the 2017/18 marketing year. Looking at the products, Argentina is expected to produce 31.8 million tonnes of soybean meal in the 2018/19 marketing year, up 3.87 million tonnes from 2017/18. Argentina is projected to produce 8.2 million tonnes of soybean oil which is up 0.96 million tonnes from the 2017/18 estimate. Looking ahead to the 2019/20 crop, Argentina is expected to crush 45 million tonnes of soybeans to produce 34.0 million tonnes of soybean meal and 8.8 million tonnes of soybean oil. The chart that follows shows that shipments of both products tend to move in lockstep with each other over time.

In its initial projection for the 2019/20 U.S. marketing year, USDA projected that U.S. soybean meal exports would slip 136,000 tonnes to 12.338 million while soybean oil exports are projected to decline 159,000 tonnes to reach 816,000 tonnes. This trend suggests that USDA expects that the U.S. will eventually concede some of the additional demand that it had gained following the short soybean crop harvested by Argentina in 2017. It will be interesting for the market to see whether the U.S. will be able to maintain this incremental demand in the coming months as Argentina farmers collect the final 20 percent of its 2018/19 soybean crop.