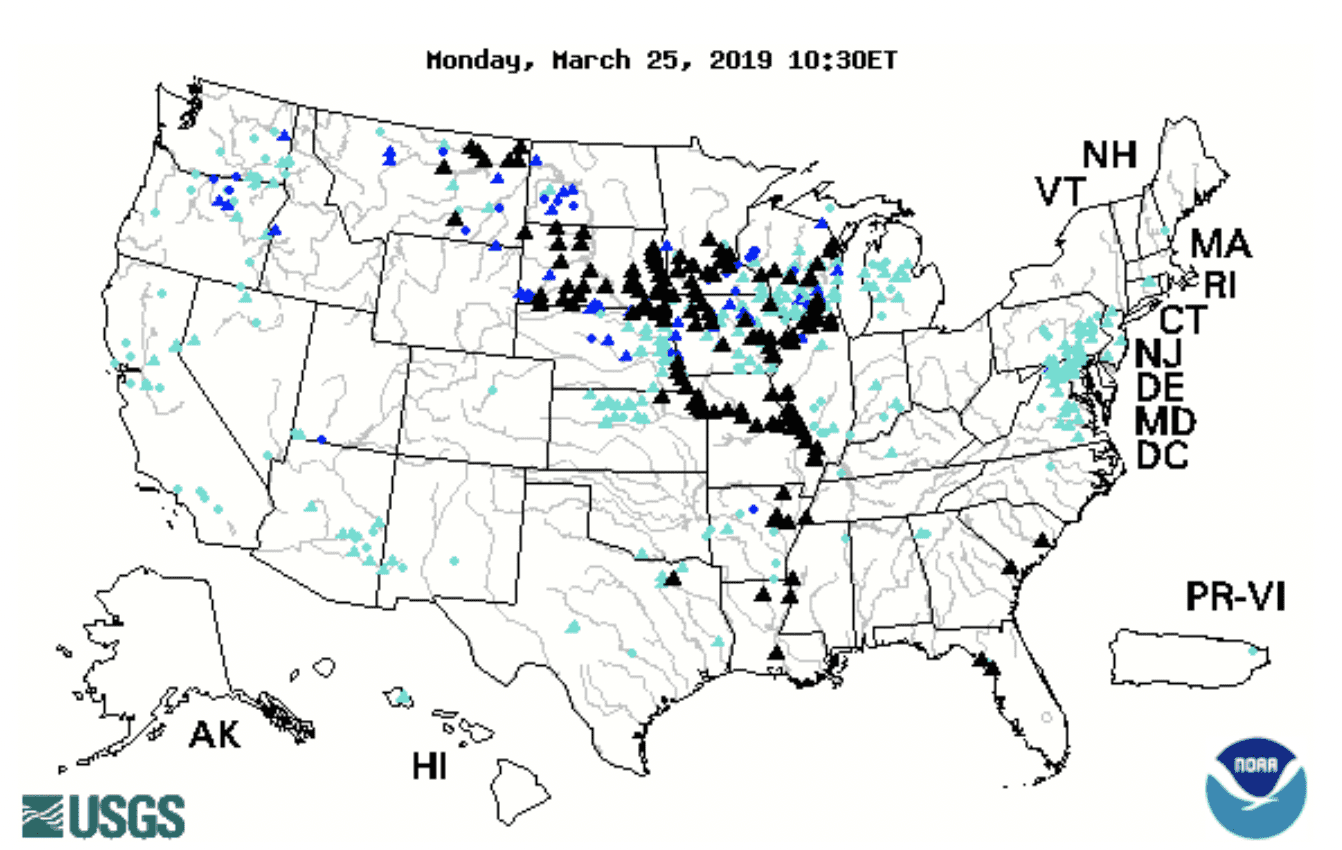

The current flooding taking place in the upper Midwestern United States sheds light on the U.S. waterways system and the need for infrastructure investment. The map below shows that the mid-Mississippi River, upper Mississippi River, and Missouri River are above flood stage.

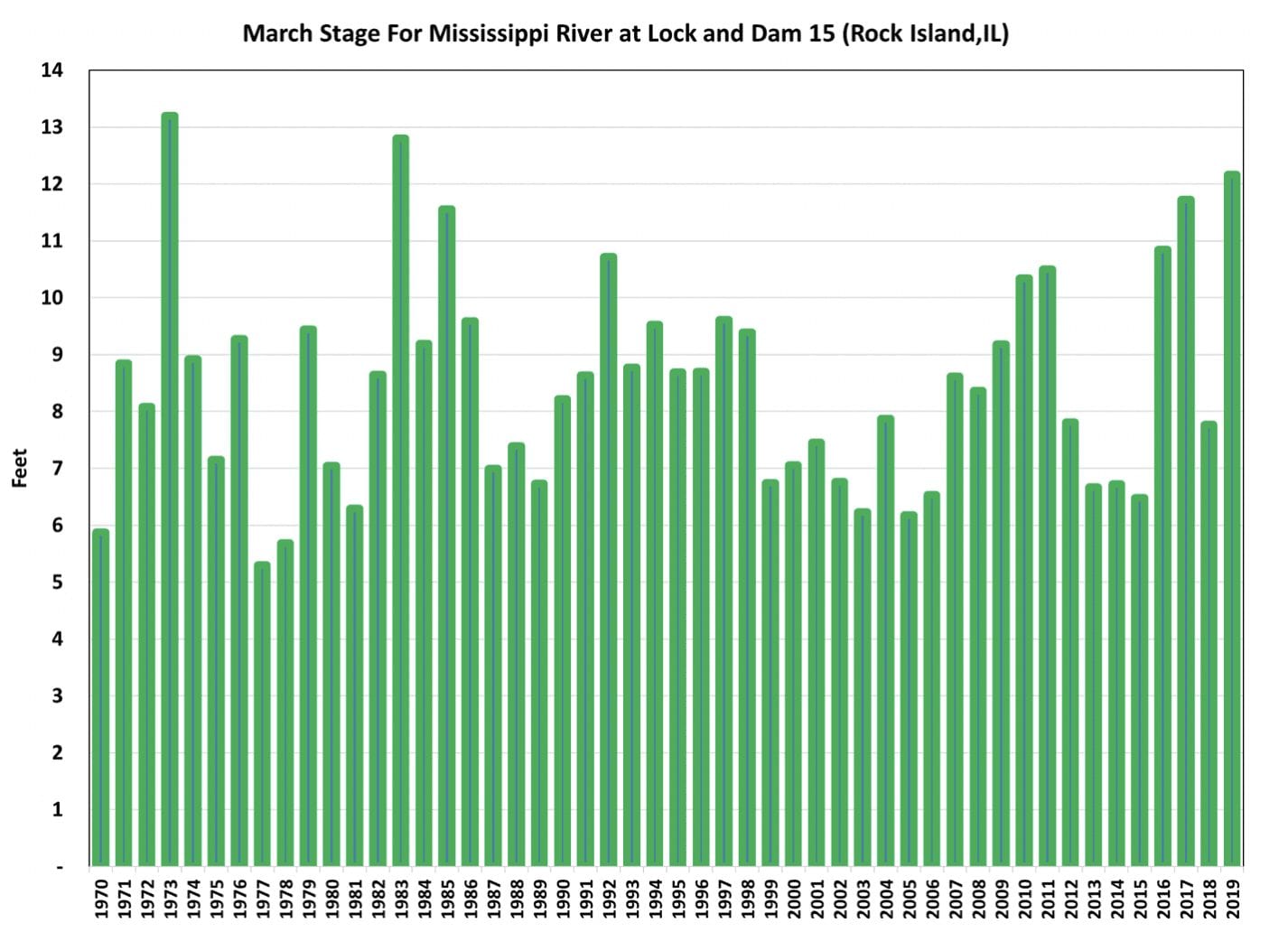

March river stage for Mississippi River at Lock and Dam 15 (Rock Island, Illinois) is well above flood level. The average stage level for the month of March 2019 is at its third highest level since 1970. Over the next few weeks, in addition to the melting snowpack, the soil in the upper Midwest is either saturated or still frozen, so any spring rainfall will runoff and not be absorbed by the soil. April is shaping up to be a difficult month for the upper Mississippi River and for the waterways in general.

March is an important month for the upper Mississippi River because that section of the river opens at that time. Thus, high water is limiting the ability of river elevators to send soybeans down to the Center Gulf for export. The current high water levels have resulted in the U.S. Coast Guard restricting barge operators to daylight hours and reduced the size of tow configurations on sections of the Inland Mississippi River System. The impact of poor river conditions translates to fewer round trips for barges, reducing the effective barge capacity and ultimately resulting in higher barge tariffs. The increase in transportation cost is two-fold as it forces country buyers to offer the farmer lower cash price bids and often leads to temporary spikes in export FOB basis levels. Farmers located in areas at flood levels that need to market product in April will be harmed by the limitations on the barge market.