The National Oceanic and Atmospheric Administration (NOAA) released the 2020 National Hydrologic Assessment report, which provides an extended forecast for water related issues. For farmers who are still feeling the impacts of the record levels of precipitation in 2019, 2020 weather pattern tracking similar to 2019 is concerning. In 2019, farmers experienced late plantings, crop yield losses, and transportation issues.

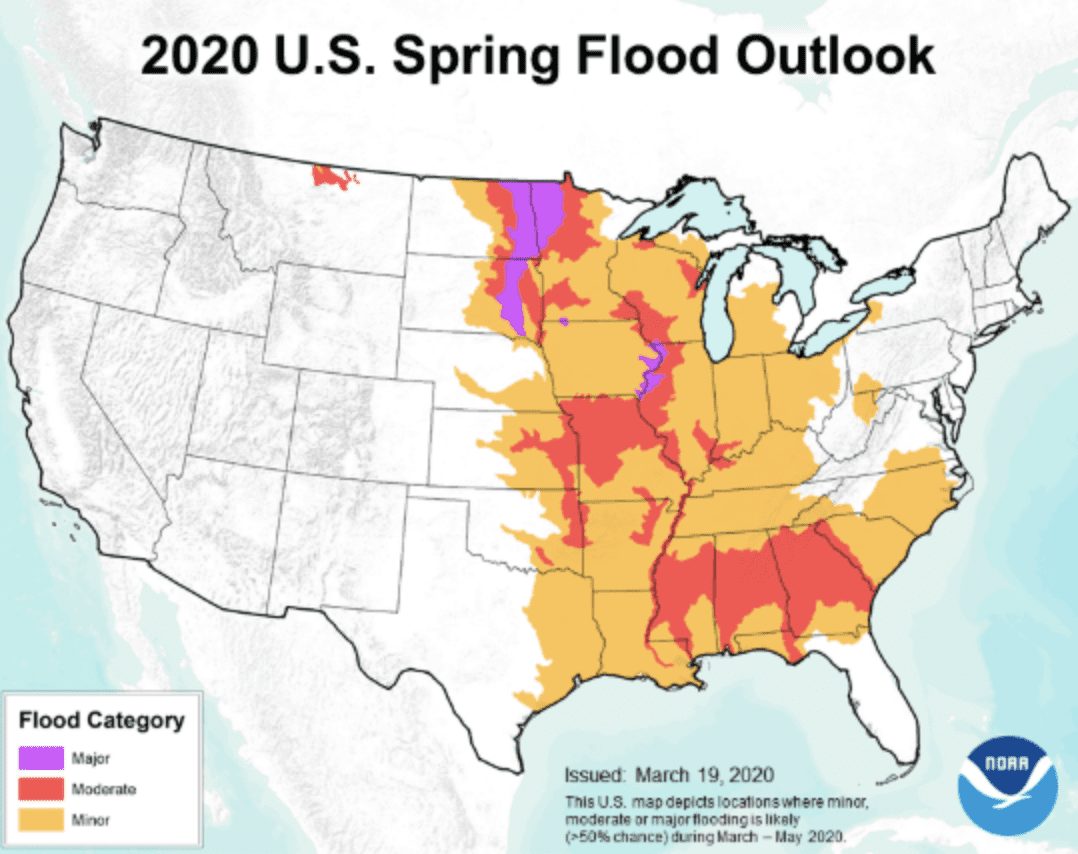

The report is based on an analysis of flood risks and water supply issues for spring 2020 based on late summer, fall, and winter precipitation, frost depth, soil saturation levels, snowpack, current streamflow, and projected spring weather. NOAA’s network of 122 Weather Forecast Offices, 13 River Forecast Centers, National Water Center, and other national centers nationwide assesses this risk. Currently, 128 million people in the United States face an elevated flooding risk in their communities, with 28 million at risk for moderate or greater flooding, and 1.2 million at risk for major flooding as shown below.

Above normal precipitation this past fall and winter has brought highly saturated soils to the Mississippi River Basin and much of the Southeast United States. Above normal snow water content across much of the Upper Mississippi River Basin is already causing rises to near and above flood stage based on snowmelt runoff. A significantly elevated risk of widespread moderate to major flooding exists this spring across the Red River of the north basins, along the mainstem Mississippi, and in the eastern third of the Missouri River Basin. Above normal precipitation this fall and winter has led to widespread flooding conditions to the Lower Mississippi River Basin, as well as much of the Southeastern U.S. This wet pattern is expected to continue across the region, with above normal precipitation forecasted into the spring. It should be noted that the information presented evaluates weekly to monthly data, not days or hours. Rainfall intensity and location can only be accurately forecast days in the future; therefore, flood risk can change rapidly.

The flood categories in the following map are defined as follows:

- Minor Flooding: Minimal or no property damage, but possibly some public threat (e.g., inundation of roads).

- Moderate Flooding: Some inundation of structures and roads near stream. Some evacuations of people and/or transfer of property to higher elevations.

- Major Flooding: Extensive inundation of structures and roads. Significant evacuations of people and/or transfer of property to higher elevations.

- Record Flooding: Flooding which equals or exceeds the highest stage or discharge observed at a given site during the period of record. The highest stage on record is not necessarily above the other three flood categories – it may be within any of them or even less than the lowest, particularly if the period of record is short (e.g., a few years).

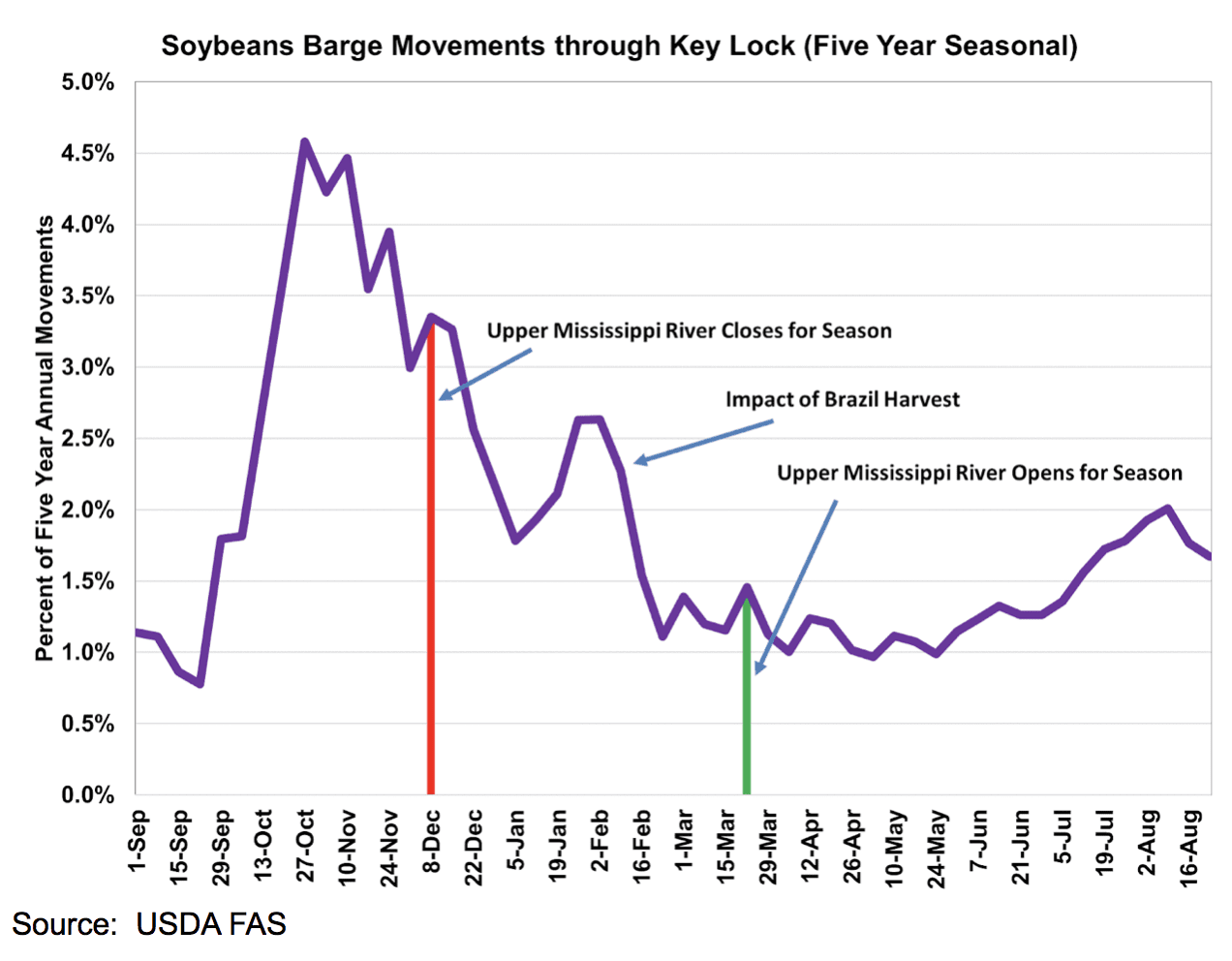

Farmers and merchandizers located in areas at flood levels that needed to market crops in March and April are harmed by the limitations placed on the Inland Mississippi Waterways System. The Inland Mississippi River system plays a major role in transporting commodities; especially soybeans and corn. Approximately 60% of all grain inspected is exported through the Center Gulf, which consists of the U.S. Customs Districts of New Orleans, Louisiana and Mobile, Alabama.

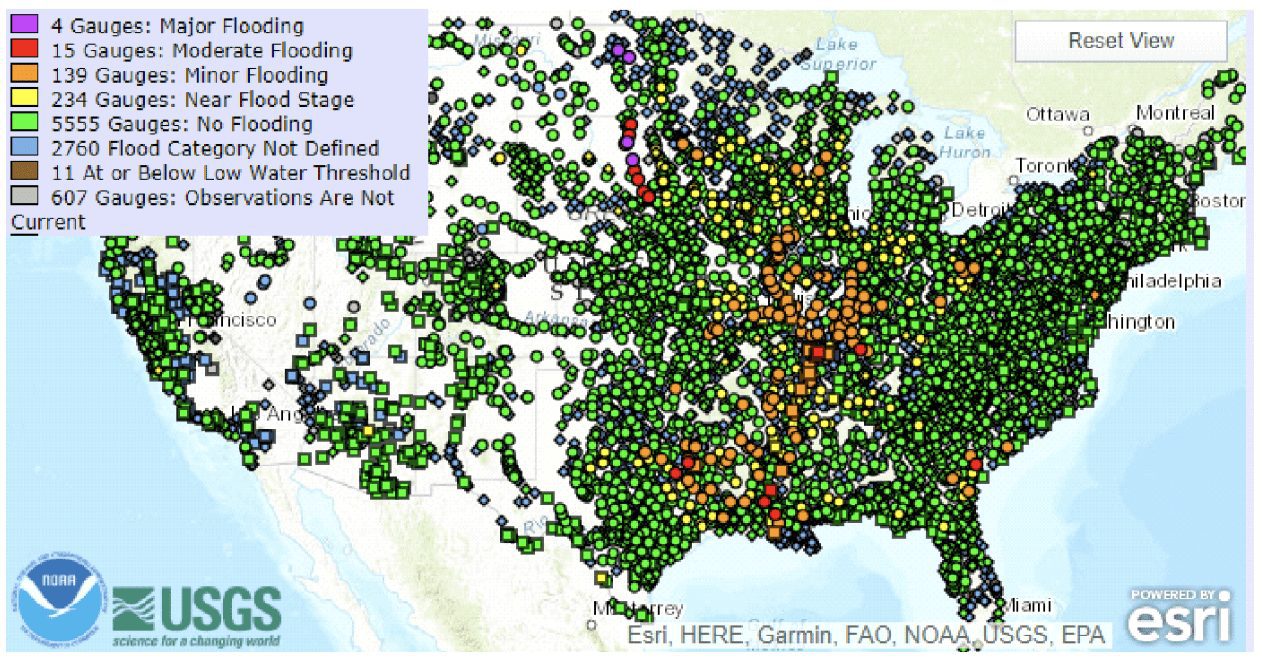

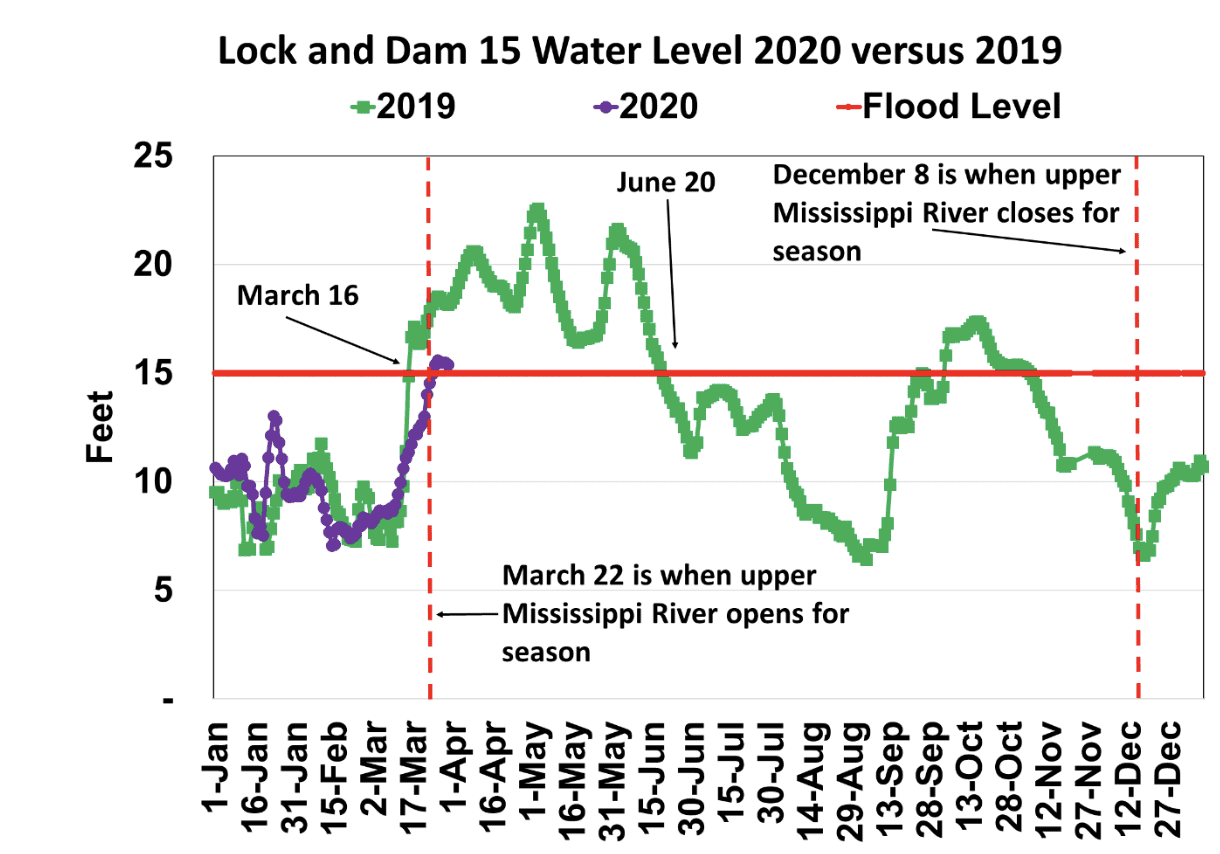

With the near record low barge rates, the barge industry is desperate for some good news, which is not yet coming. The recent heavy rains have resulted in a surge in water levels that is likely to result in the Upper Mississippi being shut down to Canton, Missouri, which shuts off the Quad Cities. The river gage forecast for Lock and Dam 15 (Rock Island, Illinois) exceeded 15 feet or flood stage on March 24 and is expected to crest at 15.6 feet.

For farmers located on the upper Mississippi River, the pain is much worse than for farmers in other regions because the upper Mississippi River is closed in the first week of December and reopens for in the second or third week of March. No corn or soybeans have locked through Lock and Dam 15 (Rock Island, Illinois) since last December.

For farmers located near the Upper Mississippi River, the export option provides a floor to the cash market. Without the river option, a farmer’s marketing options are to truck the crops to a river elevator below Lock and Dam 15, rail the crops to the Pacific Northwest or Center Gulf, sell to local operations, or keep the crops in storage. The alternatives are not as good as advertised. Trucking crops is expensive, and as the closest river elevator below Lock and Dam 15 quickly books up, the trip to the next river elevator becomes longer and more expensive. The textbooks will say to just switch to the next least expensive transportation mode. The reality is besides truck capacity and locomotive constraints, railroads plan labor utilization by export forecasts and assume the river will be open. The rail system cannot handle the volume that is barged without extensive planning and investment. During the low water event of 2012, the railroads indicated that major operational decisions with long-term implications were not going to be made based on an outlier. The captured supply of corn and soybeans should have the local feeding operations, ethanol plants, and crushing plants in great financial shape to buy, but the operations have limited storage. In addition, the recent collapse of the crude oil price and in turn gasoline, has made ethanol margins negative. The farmer will likely be forced to wait until the Upper Mississippi River reopens to market the crops.

Other areas of concern are the lower Mississippi River and mid-Mississippi River. American Commercial Lines is reporting that the Lower Mississippi River levels are above flood stage from Cairo to the Gulf, driving a 5 to 10 barge Tow Size reduction, or a 14% to 24% reduction in productivity. Furthermore, Coast Guard daylight restrictions in Memphis, Vicksburg, and Baton Rouge are increasing transits by one to two days or 20 to 40%. NOAA forecasts Baton Rouge to remain above the 35 ft flood stage for the next 20 days. How long flood conditions remain will depend on April rainfall.

The Coast Guard has reduced the tow configuration size on 6,000 horsepower boats to 20 barges when river level exceeds 22 feet and mandated daylight only transit through St. Louis bridges when the river exceeds 25 feet. Because most cargo on the Illinois and upper Mississippi Rivers flows through St. Louis, when water levels exceed 28 feet in St. Louis, tow configuration size on the Illinois and upper Mississippi Rivers is reduced to 12 barges from 15. If crops need to be transported, the resulting increase in transportation cost is two-fold as it forces country buyers to offer the farmer lower cash price bids and often leads to temporary spikes in export FOB basis levels.

The flood events sheds light on the U.S. waterways systems and the need for infrastructure investment. Although weather events are unavoidable, the impacts can be minimized with proper maintenance of the waterways. Proper maintenance includes funds for dredging, dike building, flood control, lock repairs, wetland creation, and much more. Hopefully, the 2020 flood event will quickly end, and the export market will be open to all farmers who rely of the Inland Mississippi River System.