The U.S. Department of Agriculture (USDA) issued its monthly World Agricultural Supply and Demand Estimates (WASDE) on Tuesday, February 11. In the report, the agency raised its world soybean carryout projection while lowering its forecast for U.S. soybean ending stocks. While these figures were both in-line with the direction of corresponding average trade guesses released ahead of the report, the size of the respective changes exceeded trade expectations in both cases.

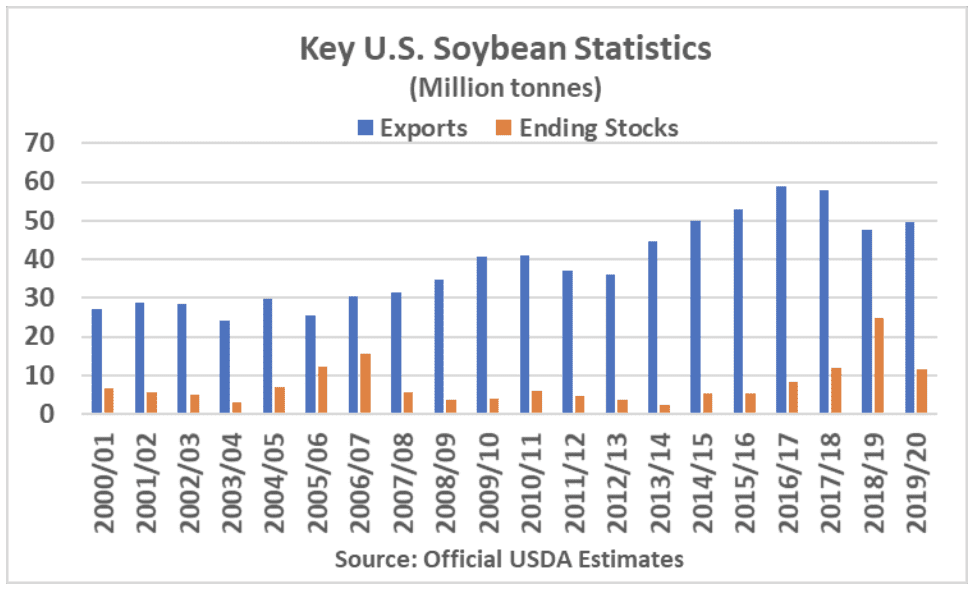

In its U.S. soybean balance sheet, the agency raised its soybean export forecast 1.36 million tonnes to 49.67 million. If realized, this would be up 2.1 million tonnes from last year but would remain below the previous five-year average pace of 53.52 million tonnes. With no other changes to its supply or demand projections, this brought U.S. ending stocks lower to 11.55 million tonnes. If realized, this would be a reduction in ending stocks of 53.3% from 24.74 million tonnes carried out in the 2018/19 marketing year but would remain comfortable when compared with the previous five-year average of 11.08 million tonnes. According to the average of guesses published by Reuters, the trade was looking for U.S. stocks to decline to 12.06 million tonnes with the increase in the export projection topping implied expectations.

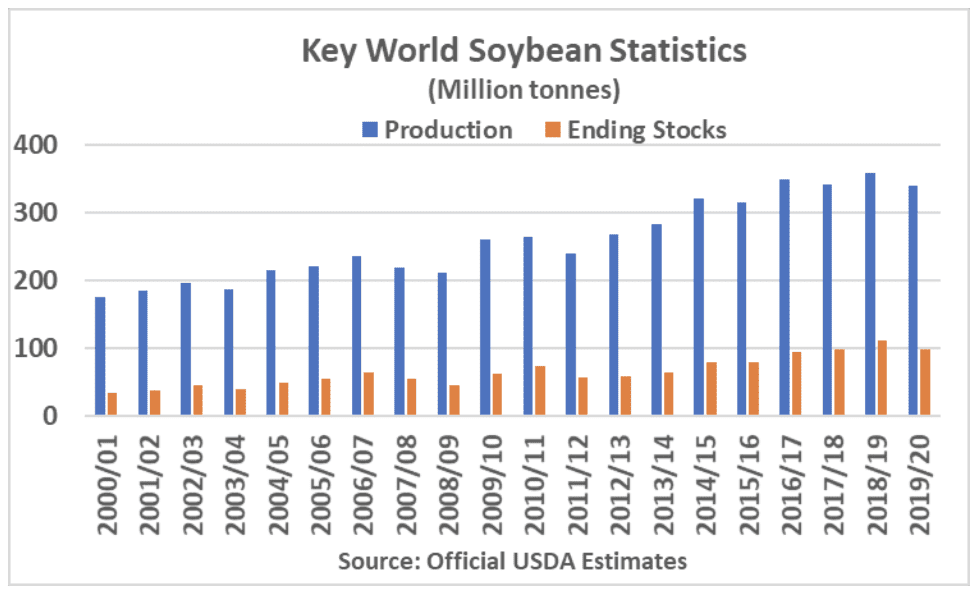

In its global balance sheets, USDA made some eye-catching updates to its foreign supply and usage forecasts that resulted in greater soybean ending stocks supplies projected at the end of the 2019/20 marketing year. World soybean output was raised 1.7 million tonnes from January to 339.40 million. The increase came via a sizeable increase of 2.0 million tonnes for Brazil that was partially offset by a reduction in output for Paraguay of 0.3 million tonnes. Argentina’s soybean crop forecast was left unchanged from January. On the demand side of its balances, USDA raised imports nearly 3.0 million tonnes to 150.80 million with the increase coming primarily from China. Domestic crushing were raised both for China and to a lesser extent Brazil. Aside from the increased U.S. exports outlined earlier, USDA also raised its projection for Brazilian soybean shipments in 2019/20 and trimmed expectations from Paraguay. Net-of all the changes, the agency projected the 2019/20 soybean carryout at 98.86 million tonnes versus 96.67 million last month and 111.22 million last year. On average, the trade was looking for a more modest increase of 96.90 million tonnes.

These contrasting changes in ending stocks appeared to have little impact on the market’s price ideas following the release, leaving the market to return its focus towards in the short-term towards South American supply potential along with perceived changes in demand for U.S. soybeans. Over the longer horizon, the potential for a rebound in U.S. soybean plantings following historic delays last year will likely become a greater feature as traders form U.S. supply ideas for the upcoming 2020/21 crop year.