Crop barge capacity is the number of covered barges in the fleet multiplied by the number of times the barge can be loaded minus other products that are transported by covered barge. The Coast Guard is requiring smaller tow configurations and Army Corps maintenance programs are reducing barge turns, which effectively decreases available barge capacity. Smaller supply should result in higher barge freight rates, but the lack of barge volume or consumption is offsetting the impact of the barge capacity constraints.

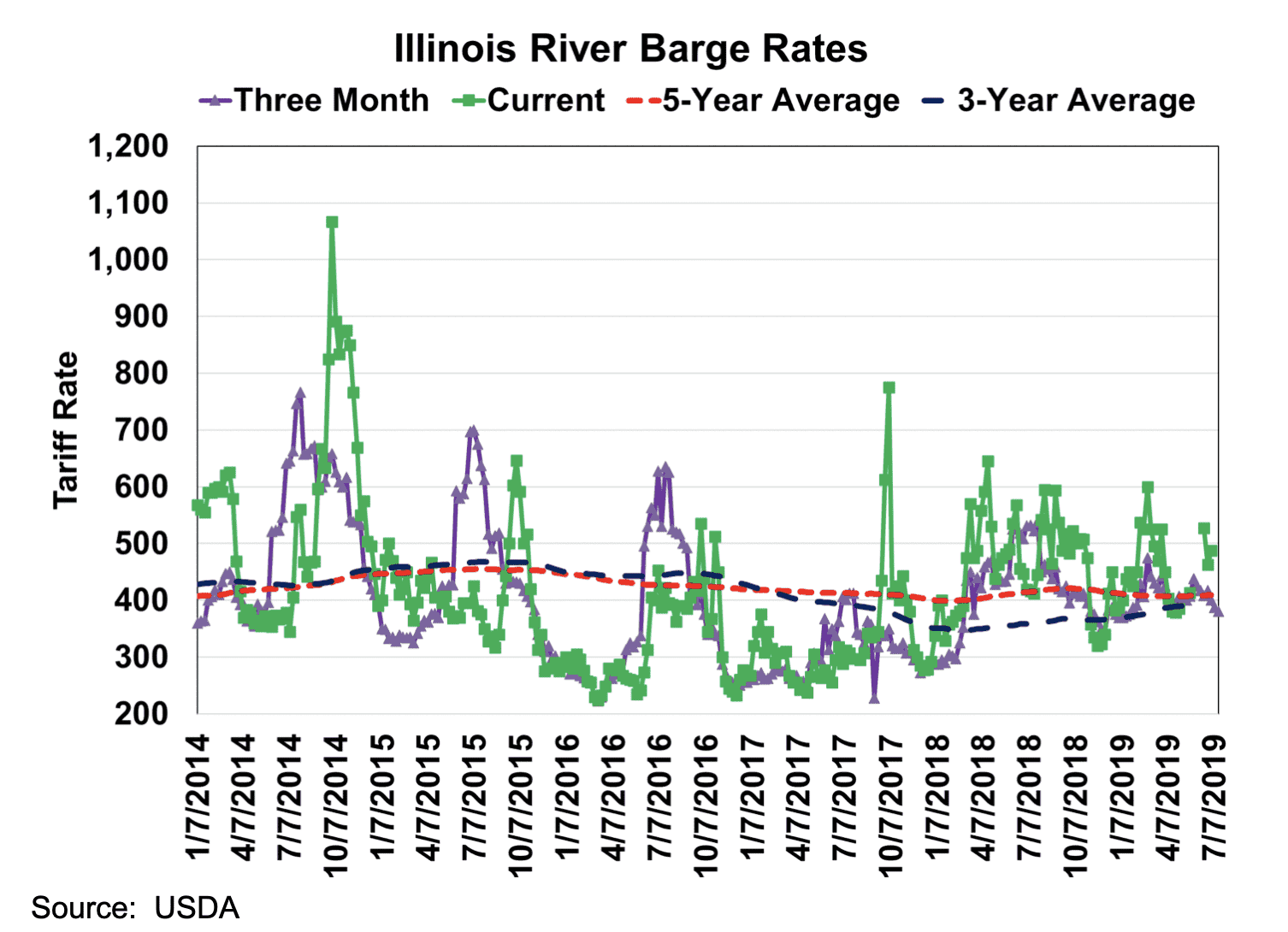

The Forward Three-Month barge rate indicates that barge rates will be slightly below the 3-year and 5-year average rate into fall. Barge rates in summer typically receive a boost from increased coal movements as air conditioners are cranked up.

The Inland Mississippi River System plays a major role in transporting commodities; especially soybeans and corn. Approximately 60% of all grain inspected is exported through the Center Gulf, which consists of the U.S. Customs Districts of New Orleans, Louisiana, and Mobile, Alabama. The Center Gulf price minus the barge freight cost and truck rate to the river is essentially the farm price. Lower barge freight rates increase the interior cash price.

In future years, barge freight rates will have to increase. The higher operational costs associated with the high-water conditions without a boost in barge rates will lead to more consolidation this year. The three-year average barge freight rate is basically the same rate received ten years ago. Over the last ten years, everything associated with the barge industry has increased in cost. The barge industry has undergone dramatic consolidation over the past thirty years and will continue to consolidate until the industry’s revenues and costs come into alignment, which will result in higher barge freight rates. The impact of higher future barge rates due to the floods this year will be felt by farmers for many years.