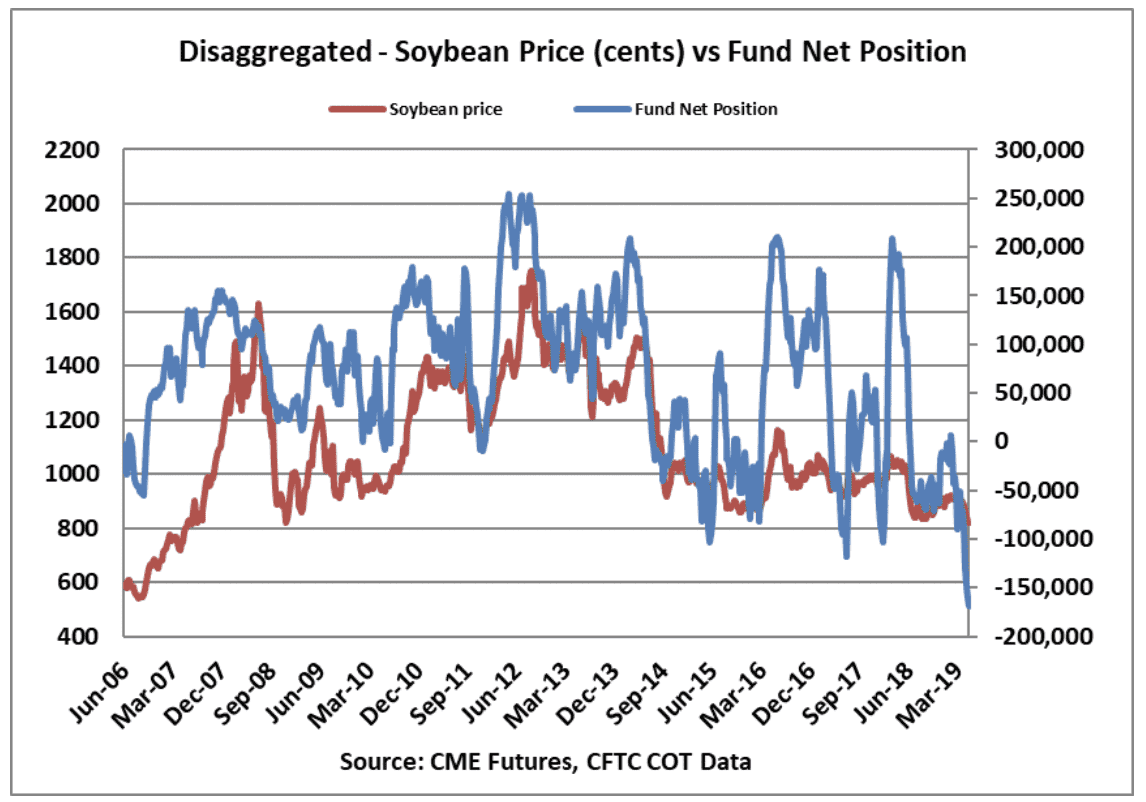

The managed money group was shown to have amassed a record net-short position as of mid-May, according to the Commodity Futures Trading Commission. The managed money group, which reports major commodity funds, was shown to have held a combined futures and options position totaling 168,835 contracts. This was up 8,835 contracts from the previous record week. Looking at historical data, the bearish position held by the managed money group has been growing in each of the past five weeks and the category has been net-short consistently since mid-February. The following chart shows the relationship between the nearby Chicago Mercantile Exchange (CME) soybean futures close, the red line measured on the left, against the managed money group’s net-position, the blue line measured on the right, since mid-2006. The scale of the charts have been adjusted to show the correlation between movement in the position of managed money and movement in futures prices.

Looking at the chart, we can see that, historically, managed money tended to favor being net-long in the CME futures market. Prior to 2019, the group had briefly held sizeable net-short positions in the soybean market in Q4 2018, early-2018 and mid-2017. What is particularly interesting about the current position is that, in addition to its greater size, the current net-short position held by commodity funds comes at a volatile time for the market as U.S. farmers are in the midst of planting their summer crops. The potential for adverse weather conditions to prevent timely planting of the summer crops makes this a risky time to have such bearish bets in any market, and this has the potential to add some excitement to the market in the coming weeks should U.S. corn and soybean plantings remain behind their respective normal paces.