As the U.S. market focuses on the weather as soybeans move into the final development stages of growth, Brazilian farmers are eyeing key factors that will ultimately drive their planting decisions for the upcoming crop to begin hitting the bins in earnest early in 2020. 2019 proved to be such a sizeable crop due to expanded plantings from early pre-monsoon rains while output was limited as yields were curbed in key growing areas in the center-west region including top producer Matto Grosso. The stage appears to be somewhat different as key planting dates approach ahead of the 2020 crop.

The beginning of September typically marks the start of the earliest corn and soybean plantings for farmers in South America. In Brazil, farmers must wait at least sixty days between the harvest of one soybean crop and the planting of another. This industry standard rule is intended to prevent the spread of fungal diseases, such as soybean rust, which can spread from one crop to another. That period is dependent on the region and for this year the starting date in Parana is September 11 while Mato Grosso farmers can begin seeding on September 15. Beyond this 60-day period, farmers typically wait for longer days and timely rainfall to help improve early seed development.

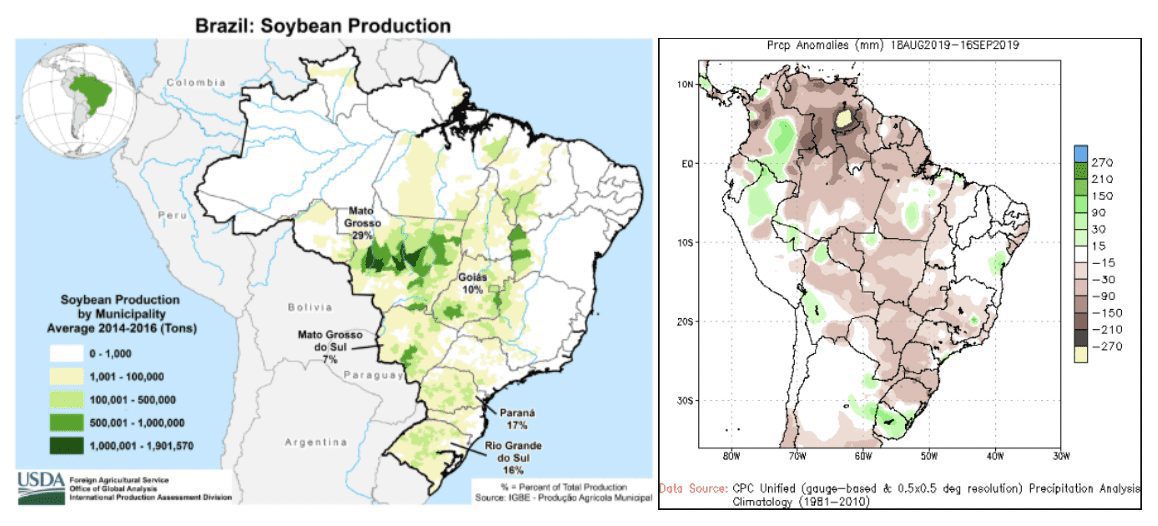

The following maps show the major Brazilian soybean growing areas based on 2014-16 output and the recent thirty-day precipitation anomalies for Brazil. The light brown areas indicated precipitation totals some 15 to 90 millimeters below normal through the second week of September. As is evident, many of these deficit areas overlap with key soybean areas. While this pattern has been beneficial for harvesting winter wheat and cotton crops, the dry pattern is not welcomed ahead of soybean plantings. Looking ahead at the current extended forecasts, it appears that farmers will need to remain patient, but all is far from being lost. Private forecasters have highlighted the exceptional arrival of pre-monsoonal rains to Brazil last year and are warranting patience before writing off the 2019/20 potential.

For farmers in Brazil, there has been little discussion relating to input costs, but the mainstream media has publicized ongoing fires in the Amazon region and reports have pointed the finger at soybean producers as the cause. Local sources contend that the regions being burnt are not major soybean-producing areas and estimate that the areas in question planted just 30,000 of the 36 million hectares planted to soybeans last year. Still, commercial grain handlers are working to ensure that their supply chains are not tied to the spots in question for obvious reasons in terms of public relations.

For farmers that already work cleared land, the ongoing trade war between the U.S. and China is expected to keep soybean plantings in vogue in the upcoming crop year. Soybeans continue to grow in popularity with Brazilian farmers at the expense of first season corn, but with larger plantings have also come greater safrinha corn seedings. Brazil’s Foreign Agricultural Service (FAS) Post issued its latest forecast in late June for corn harvested area to expand 3.4% in 2019/20 to reach 18 million hectares, while the Post’s latest forecast for soybean plantings calls for a rise of 2.2% to 37 million hectares. Soybeans, the Post noted, are said to be the most liquid crop grown in Brazil making it an ever-more attractive option for growers. The amount of growth, however, is limited due to land constraints, as many growers have already maximized their ground planted to soybeans. Another factor noted by the Post in limiting the growth in soybean plantings for 2019/20 is the lower demand from China as the domestic pig herd looks to rebound from the African swine fever epidemic.

The bottom line for the early Brazilian outlook is that expanded soybean plantings are expected to result in ample new-crop soybean supplies early in 2020; however, the dry start to plantings and some environmental concerns are casting a shadow of doubt as to the outlook for Brazilian soybeans. The market is expected to keep an eye on the weather, and any new developments regarding global trade and fires in the Amazon region.