One could argue that China, India, and developing Asia (Asian Growth Center) would not have improved as much as they have without the natural resources in South America and Australia. Over the last two decades, the Asia Growth Center has switched from being a leading exporter of coal and iron ore to the largest importer. South America and Australia provided the resources required to enable this economic growth to continue.

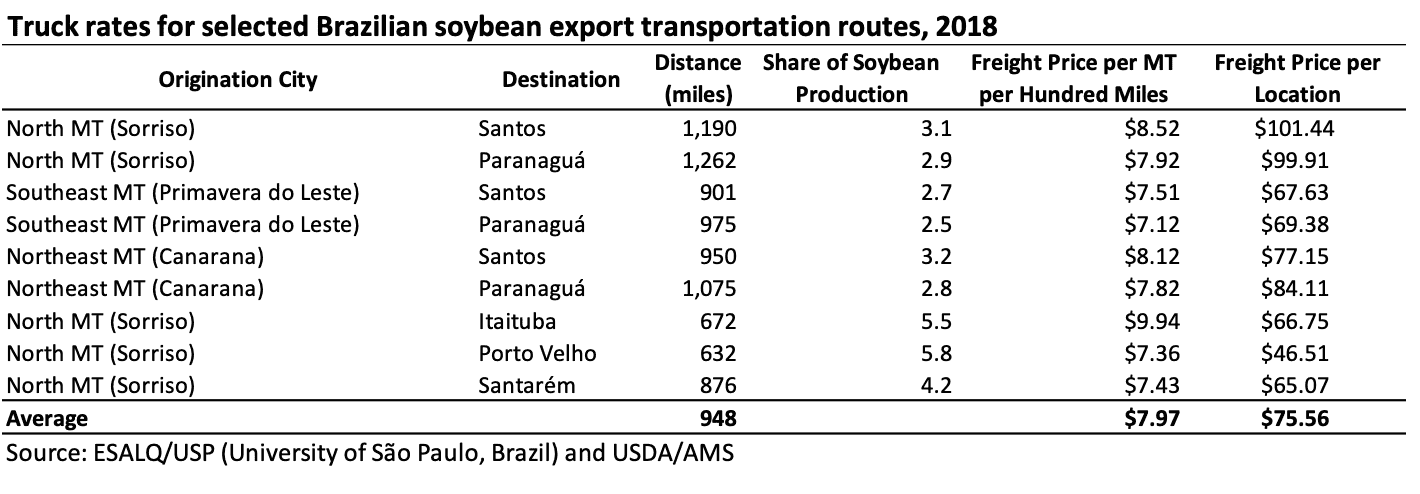

For agriculture, South America’s land expansion has allowed the Asian Growth Center to increase its consumption of food products. Crop prices must reach a level to cover the higher costs associated with the new land being brought into production. For the new land brought into production, the largest cost for exporting soybeans is transportation. Ultimately, Brazilian and American port prices are linked, which filters back to farmers.

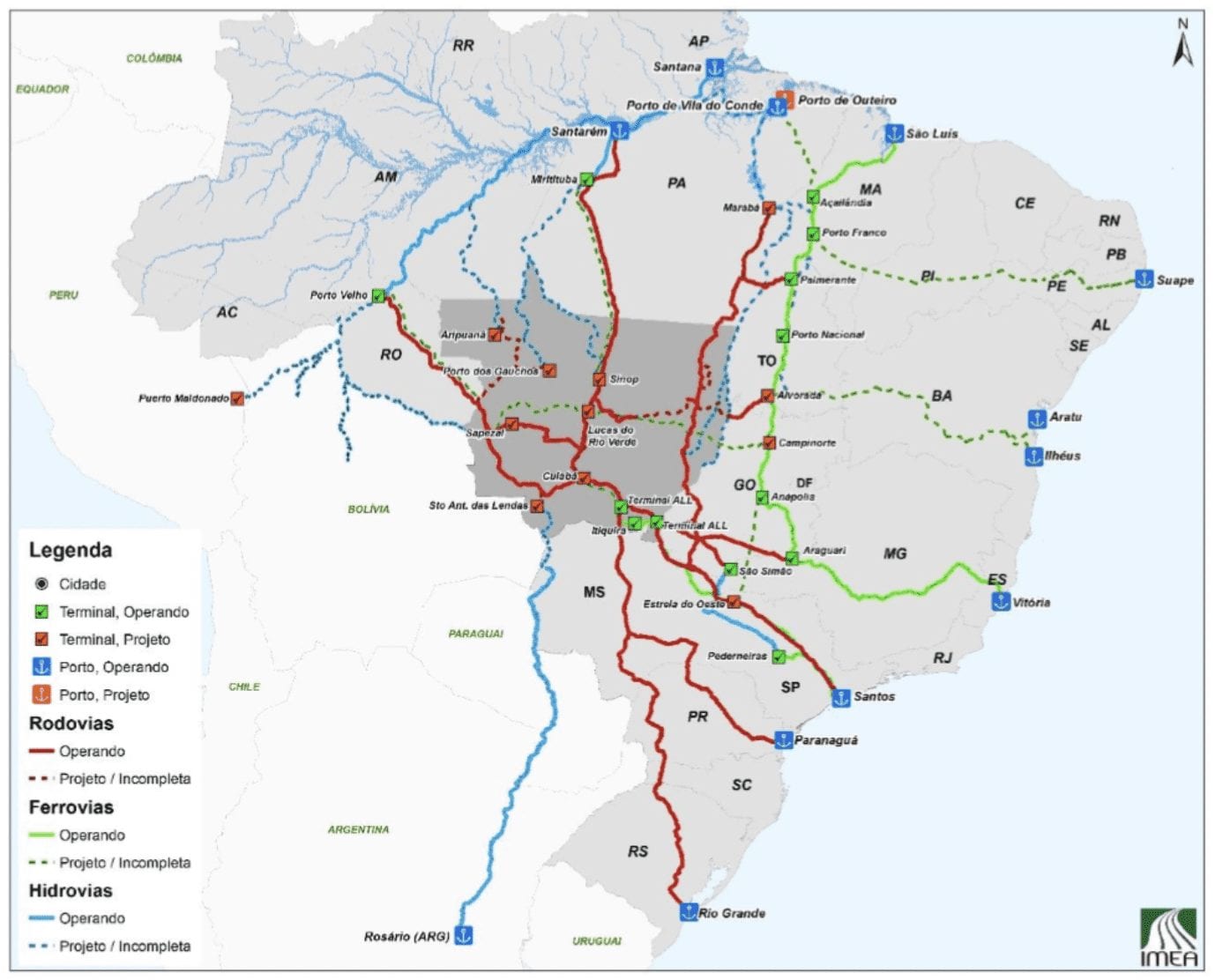

The Mato Grosso Institute of Agricultural Economics (IMEA) map below clearly shows the aggressive plans by the Brazilian government to improve transportation and improve Brazilian farmers’ world competitiveness. The legend is as follows:

| Red lines | Operational highways |

| Red-dash lines | Projected or incomplete highways |

| Green lines | Operational railroads |

| Green-dash lines | Projected or incomplete railroads |

| Blue lines | Waterways where barging is operational |

| Blue-dash lines | Projected or incomplete waterways |

| Small green square | Operational grain terminals |

| Small red square | Projected grain terminals |

| Large blue square | Operational ports |

| Large red square | Projected ports |

What is interesting is almost all the transportation projects already have an established port. Instead of “build it and they will come,” it is “build it because we are already here.” If the $76 per metric ton were lowered by $20 per ton, the Brazilian farmer would either make 55 cents more per bushel or lower the world price 55 cents per bushel. As acreage continues to increase to meet world demand, the financial benefit for transportation companies and the government to complete the transportation projects will increase, which in turn increases the likelihood of eventual completion.