One of U.S. Soy’s greatest advantages is the Inland Mississippi River System, which is comprised of navigable waterways that run through the heart of U.S. corn and soybean production as shown below. The Inland Mississippi River System originates a tremendous amount of grain and soybeans for export. For this reason, it is very important the locking reaches of the Inland Mississippi River System are fully operational.

The largest commodity in terms of barge movement volume is coal, which continues to decline as coal plants switch over to natural gas. The Energy Information Agency (EIA) continues to forecast a decline in domestic coal consumption. The explosion in higher U.S. liquid natural gas exports is replacing potential coal exports domestically and abroad.

In terms of ton-miles, grain and soybeans are the most important commodities. A ton-mile is the distance that the barge will travel multiplied by the number of tons loaded on the barge. Crop barge movements are a much longer distance than coal barge movements. Crude oil is very profitable but is transported in a tank barge. Coal and crops are transported in a dry barge with coal in an open barge and crops in a covered barge. Coal barge movements continue to decline and without a major infrastructure bill that increases the movements of other bulk commodities, such as concrete, steel, and aggregates, barge commodity movements will remain even or decrease in 2021.

Illinois River Shut Down

With the locks and dams well beyond the 50 lifespans, the work being completed on the Illinois River and Upper Mississippi River is long overdue. Due to the importance of the waterways for agricultural exports, the shutdowns and slowdowns does impact farmers.

The LaGrange Lock and Dam is central to the farming community as it is the last lock before the Illinois River joins with the Mississippi River. Of the 15 million tons of food and farm products transported on the Illinois River, 12 million tons came through the LaGrange Lock and Dam. In 2017, the average delay per tow was 7.95 hours. By comparison, Peoria Lock and Dam was only one hour. If the rehabilitation decreases the average delay per tow by seven hours, with an annual loaded barge volume of 17,282 barges or 1,152 tows assuming 15 barges per tow, the rehabilitation will save 8,035 hours per year.[1] The real importance is that the shippers on the Illinois River have confidence the lock and dams will be passable.

According to the USDA Grain Transportation Report of July 2, 2020:

For shippers who normally use the closed portions of the river, some barge options remain. Eighty miles of open river below LaGrange Lock and Dam will still be accessible. However, many shippers in Illinois will be closer to the Mississippi River than the open portions of the Illinois River. For periods when both locations are available for shipping, freight rates for grain shipments originating from the Mid-Mississippi River are, on average, 19% higher in cash price than shipments originating on the Illinois River. Logistics-based cost increases to carriers due to increased congestion in the Mid-Mississippi could push freight prices above normal.

Nonetheless, signs of downward pressure on prices in the upcoming months have appeared: redeployment of towboats and barges from the Illinois River to the Mid-Mississippi may create surplus capacity. Mid-Mississippi rates have decreased recently as barges leave the Illinois, anticipating the closure. The rate decrease suggests the surplus of towboats and barges on the Mid-Mississippi may be the prevailing factor in determining prices—curbing potential rate increases. Companies that must get grain on the Illinois, such as ethanol refineries, can charter small barge fleets to remain on the river to ensure a steady supply of grain.

The Rock Island District of Army Corps states:

Originally, six extended lock closures were planned for the summer of 2020 in order to complete long overdue maintenance on the aging infrastructure. Due to significant workload, the contractors involved are unable to undertake the maintenance work at Brandon Road Lock and Dam. Consequently, only five lock closures are now slated to include Starved Rock, Marseilles, Dresden Island, Peoria and LaGrange Locks and Dams.

2020

LaGrange Lock and Dam – Major Rehabilitation & Lock Machinery Replacement

Full closure scheduled July 1-Sept. 30

Peoria Lock and Dam – Dewatering for Maintenance and Inspection

Full closure scheduled July 6 – Sept. 30

Starved Rock Lock and Dam – Upper & Lower Miter Gate Installation

Full closure scheduled July 1-Oct. 29

Marseilles Lock and Dam – Upper Miter Gate Installation

Full closure scheduled July 6-Oct. 29

Dresden Island – Upper Bulkhead Recess Installation

Partial Closure scheduled July 6-Oct. 3 and Oct. 25-Oct. 28

Locks operational from 6 p.m. to 6 a.m. with a 70-ft width restriction and no ability to pull unpowered barges.

Full Closure scheduled Oct. 4-Oct. 24

In addition to the Illinois River, some critical backlog of maintenance items on the Upper Mississippi River is also receiving attention.

Repair L/D 15 Guide Wall

Repair L/D 13 Overflow Spillway

Repair L/D 15 Service Bridge

Install Safety Guard Rail at Multiple Sites

Repair Dock Wall at Mississippi River Service Base

Repair Mississippi River Wing Dams

Install newly procured Lock Gates (Miter and Lift) at LD’s 12, 15, 15A, and 19

Repair Bulkhead Recesses at Starved Rock and Marseilles L/Ds

Repair Peoria L/D Wicket Dam

Repair Electrical Service & Sheet Pile Wall at Peoria Service Base

Install newly procured Dam Gates (Tainter) at Dresden Island[2]

Barge Freight Rates

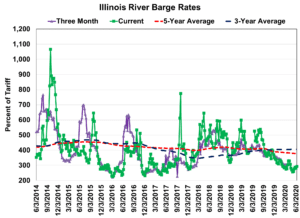

The barge freight rates continue to remain near historical lows. (A detailed explanation of barge freight rate calculations is provided at the end of the section.) The spot rate for the percent of Illinois River Barge Tariff Rate is below 300%. The three-month rate is not offered because of scheduled lock and dam work.

The barge rates were lower in 2019 versus 2018 despite river conditions that greatly increased operating costs. By comparison, the last time the river was closed due to high water in 2014, the percent of the Illinois River Barge Tariff Rate exceeded 1,000% versus in 2019, the percent of tariff for the Illinois River only exceeded 600% one week and fell below 400% during one of the most extreme weather events in U.S. history.

While the oversupply of barges versus demand is taking a toll on barge companies, the tariff rates not skyrocketing is positive for soybean farmers. Declining barge freight rates will improve the crop basis in the Corn Belt.

Barge Freight Rate Calculations:

According to the U.S. Department of Agriculture (USDA) Agricultural Marketing Service (AMS), “the U.S. Inland Waterway System utilizes a percent of tariff system to establish barge freight rates. The tariffs were originally from the Bulk Grain and Grain Products Freight Tariff No. 7, which were issued by the Waterways Freight Bureau (WFB) of the Interstate Commerce Commission (ICC). In 1976, the United States Department of Justice entered into an agreement with the ICC and made Tariff No. 7 no longer applicable. Today, the WFB no longer exists and the ICC has become the Surface Transportation Board of the United States Department of Transportation. However, the barge industry continues to use the tariffs as benchmarks as rate units.

To calculate the rate in dollars per ton, multiply the percent of tariff rate by the 1976 benchmark. As an example, a 200 percent tariff for Minneapolis-St. Paul barge grain would equal 2.00 times the benchmark rate of $6.19, or $12.38 per ton. Each city on the river has its own benchmark (see table below), with the northern most cities having the highest benchmarks.”

[1] https://usace.contentdm.oclc.org/utils/getfile/collection/p16021coll11/id/2956

[2] https://www.mvr.usace.army.mil/Missions/Navigation/Navigation-Status/