As the calendar approaches the final days of July, the U.S. soybean export program is approaching the final month of the 2018/19 marketing year. This will leave just over 4 weeks to determine the ultimate size of the current U.S. shipping campaign.

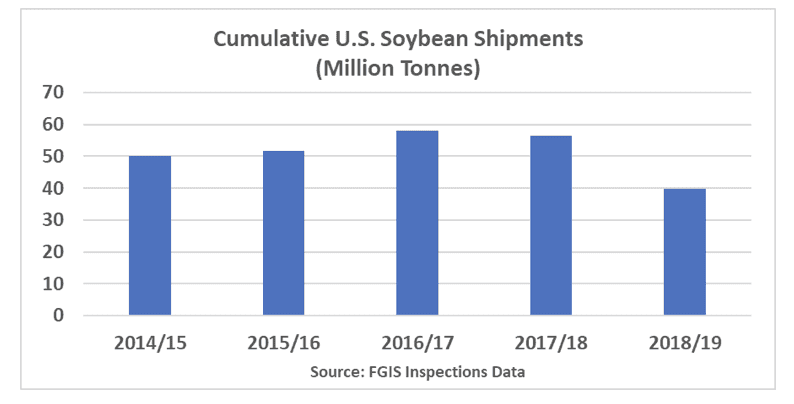

According to the latest Federal Grain Inspections Services (FGIS) data, cumulative soybean shipments inspected for export have totaled approximately 40.312 million tonnes through July 25 compared with 52.666 million tonnes through the same week last year. In the previous four years, final inspections totaled nearly 50 million tonnes or better, while this year it appears likely that streak will end with the U.S. Department of Agriculture’s (USDA) official July forecast of 46.27 million tonnes.

According to the latest Foreign Agricultural Services (FAS) export sales data, there were outstanding sales awaiting shipment of U.S. soybeans totaling 8.563 million tonnes as of mid-July. This compares with 6.526 million tonnes the same week last year and a previous 5-year average for mid-July of 3.838 million tonnes. The market will continue to monitor these weekly totals as analysts begin to fine-tune their expectations for the final tally of the 2018/19 U.S. export campaign. The volumes that go unshipped will either be cancelled outright or rolled ahead for shipment in the 2019/20 marketing year.

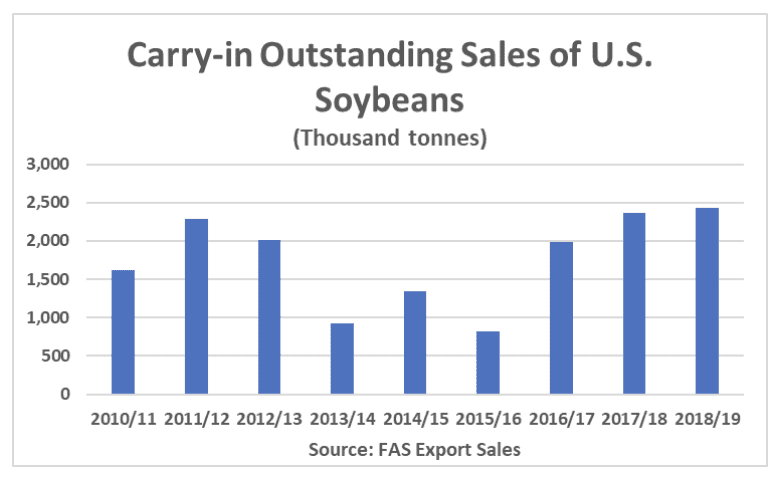

The following chart shows the recent history of carry-in sales that had been rolled into the subsequent marketing year. This chart shows that it is not uncommon for as much as 2.5 million tonnes of outstanding sales of U.S. soybeans to be rolled from one shipment period to the next. For this year, the numbers suggest that nearly 6 million tonnes of soybeans will need to be shipped by the end of August in order to reach USDA’s July forecast. This would leave about nearly 2.5 million tonnes to be rolled over into the 2019/20 marketing year. What will be particularly interesting for the market to gauge is which destinations are holding these outstanding sales. This will provide clues as to whether these volumes will ship in August or will be added to what is already expected to easily be a record U.S. soybean carryout in excess of 28.6 million tonnes.